Image

Transparency and Trust Starts with Accountants

Professional accountants play a major role in reducing corruption. The accountancy profession—acting in the public interest—is an important part of national governance architectures that confront corruption, in partnership with good governance and strong businesses. Professional ethics, education, and oversight—at the core of the global accountancy profession—are key to our positive impact in tackling corruption.

This IFAC report details the accountancy profession's role in the global fight against corruption to advance strong businesses.

Image

Professional accountants play a major role in reducing corruption

Key Findings

Where governance is strong, the role played by professional accountants in tackling corruption is amplified.

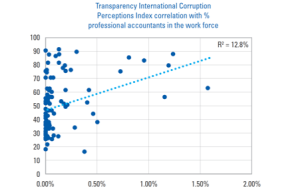

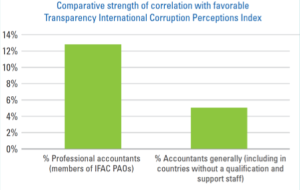

Professional accountants are a part of governance architectures that tackle corruption. Their positive contribution is amplified where the architecture is stronger. The link between the prevalence of professional accountants in the workforce, and more favorable scores on the main global measures of corruption, is stronger in G-20 countries, and in countries that have adopted anti-money laundering laws in line with international recommendations.

Professional ethics, education, and oversight—at the core of the global accountancy profession—are key to the positive role played in tackling corruption.

Core qualities that make accountancy a global profession are its robust international Code of Ethics, comprehensive educational requirements, and ongoing monitoring and oversight mechanisms. The link with more favorable corruption scores is three times stronger for professional accountants that have committed to these qualities than for individuals who may identify as accountants but do not possess professional qualifications (for example, in countries where professional qualifications are not required, or individuals working in support roles).

The Accountancy Profession: Supporting Anti-Corruption Efforts

The accountancy profession helps combat both the opportunity and the cost of fraud and corruption. Professional accountants are uniquely positioned to make a positive contribution because of their work throughout the global economy. They work in public and private sector organizations, in small- and medium-sized practices, in larger global networks that provide audit and tax services, and in academia—conducting research and helping to educate our next generation talent.

Learn more about the work of professional accountants in this fight.

- The Accountancy Profession: Fighting Fraud and Corruption, An Open Letter to His Holiness Pope Francis by Olivia Kirtley, IFAC President (2014-2016)

- A New Weapon in the Mexican Fight Against Business Corruption by José Raúl González Lima, Director of Corporate Financial Reporting, Grupo Televisa and member of the IFAC Professional Accountants in Business Committee

- Accountants as Partners in Crime Prevention & Reporting by Samantha McDonough, Professional Standards Support Manager, Chartered Institute of Management Accountants

- Public Sector Financial Problems Coincide with Societal Ones by Nicolas Véron, Economist and Senior Fellow, Bruegel

- How Clean Is Your Business? by Tanya Barman, Associate Director, Ethics, Chartered Institute of Management Accountants

The Nexus Series

Over the last two years, IFAC has commissioned the independent Centre for Economics & Business Research (Cebr) to examine the accountancy profession’s role in society.

The Accountancy Profession—Playing a Positive Role Tackling Corruption is the third report in this series and provides a snapshot of the accountancy profession’s role in the global fight against corruption.

The first report, Nexus 1: The Accountancy Profession, Behind the Numbers, highlights the importance of professional accountants to growing economies, and compared the profession’s growth with total employment growth within regions. The overall picture showed a profession in demand, growing steadily, and making significant contributions to all areas of society.

The second report, Nexus 2: The Accountancy Profession—A Global Value-Add, provides a snapshot of the accountancy profession’s economic contribution to the global economy, and to society.