2023 Handbook of the International Code of Ethics for Professional Accountants

Including International Independence Standards

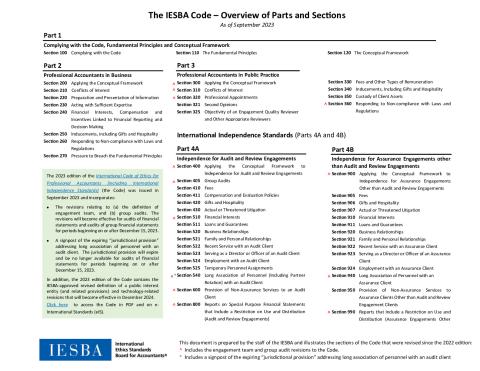

This 2023 edition contains recently approved revisions to the Code, including:

- The revisions relating to (a) the definition of engagement team, and (b) group audits. The revisions deal with the independence and other implications of the changes made to the definition of “engagement team” in the Code to align with changes to the definition of the same term in the IAASB’s International Standards on Auditing (ISAs) and International Standards on Quality Management (ISQMs). The revisions also address holistically the various independence considerations in an audit of group financial statements. The revised provisions relating to the definition of engagement team and group audits will be effective for audits of financial statements and audits of group financial statements for periods beginning on or after December 15, 2023. Early adoption of the revisions is encouraged.

- The upcoming expiry of the “jurisdictional provision” addressing long association of personnel with an audit client. The jurisdictional provision will expire and be no longer available for audits of financial statements for periods beginning on or after December 15, 2023. Under the jurisdictional provision (paragraph R540.20 of the Code), where a legislative or regulatory body (or organization authorized or recognized by such legislative or regulatory body) has established a cooling-off period for an engagement partner of less than five consecutive years, that shorter cooling-off period may be applied, subject to a floor of three years, provided that the applicable time-on period does not exceed seven years.

The back of the 2023 Handbook contains the IESBA-approved revisions to the Code, which are not yet effective. These revisions will become effective in December 2024 and include:

- Revisions to the definition of a public interest entity (PIE).

- Changes to the definitions of “audit client” and “group audit client” in the Glossary arising from the approved revisions to the definitions of listed entity and PIE.

- The technology-related revisions.

Copyright © 2024 The International Federation of Accountants (IFAC). All rights reserved.