Image

Pakistan was put on the Financial Action Task Force’s (FATF) list of jurisdictions under increased monitoring, more commonly known as the “Grey List,” in 2018. In October 2022, Pakistan was removed from the FATF Grey List due to significant improvements in the overall anti-money laundering (AML) / counter-terrorist financing (CFT) framework. The Institute of Chartered Accountants of Pakistan (ICAP) was an active participant with government and other key stakeholders in making the necessary reforms to get Pakistan off the FATF Grey List. This case study profiles ICAP’s engagement with the reform journey in Pakistan and details the significant organizational changes that ICAP undertook to fill its new role as designated AML/CFT Regulator.

FATF’s Mutual Evaluation of Pakistan – 2018

In October 2018, Pakistan was subject to a mutual evaluation by the Asia Pacific Group (APG), the largest FATF-style Regional Body (FSRB) with 41 member jurisdictions in the Asia Pacific region. In the resulting Mutual Evaluation Report for Pakistan (published October 2019), a significant number of deficiencies in the Pakistani AML/CFT framework were identified.

Key findings of the 2018 Mutual Evaluation included the following:

- The National Risk Assessment conducted by Pakistani authorities in 2017 was deficient. While Pakistan had established a multi-agency approach to implement its AML/CFT regime, it was not implementing a comprehensive and coordinated risk-based approach in combating Money Laundering (ML) and Terrorist Financing (TF).

- While Pakistani Law Enforcement Agencies (LEAs) had measures to freeze, seize, and prevent dealing with property subject to confiscation, LEAs were seizing some assets in predicate offences cases, but not in ML cases.

- While most Banks and larger exchange companies had an adequate understanding of their AML/CFT obligations and have conducted internal ML/TF risk assessments, there were no enforceable AML/CFT requirements for Designated Non-Financial Business and Professions (DNFBPs), as well as the Pakistan Post and Central Directorate of National Savings.

- Pakistan had limited mitigating measures for legal persons and there was no supervisory oversight for AML/CFT purposes. There were no measures in place to address the ML/TF risks posed by trusts, including foreign trusts, and waqfs in Pakistan.

- Pakistan did not have a formal framework for Mutual Legal Assistance (MLA) requests, but could execute MLAs on the basis of treaties, reciprocity and some legislative provisions.

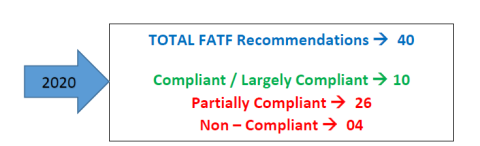

These deficiencies were reflected in Pakistan’s assessments scores against the FATF Recommendations. As of 2020, out of the 40 FATF Recommendations, Pakistan was assessed as “compliant” in one and largely compliant in nine. Pakistan received rating of partially compliant in twenty-six and non-compliant in four.

Image

In response to these findings, the government of Pakistan agreed with the FATF and the APG an initial Action Plan of 27 distinct action items, coupled with a second action plan of seven action items, encompassing 34 action items in total. Considering the importance of the matter to the economy and society, the Government of Pakistan provided its firm commitment to the FATF/APG and carried out significant measures nation-wide to complete the action plans.

Establishing a New National Architecture for AML and Implementing the Action Plan

The reaction of the Government of Pakistan to the agreed Action Plan was swift and extensive, with a comprehensive national architecture put in place, including seven ministries of the government and 50 departments and organizations (such as the Securities and Exchange Commission of Pakistan, the oversight body for ICAP and ICMAP; and the Ministry of Law and Justice as the oversight body for the Pakistan Bar Council). The core of this architecture was the establishment of a dedicated secretariat by the government, the National FATF Secretariat. The main objective of this secretariat was to coordinate with all the stakeholders including the AML/CFT Regulators and LEAs and with the FATF/APG team.

After the development of this national architecture, detailed assessments were carried out. For this purpose, consultants were appointed to identify gaps in the AML/CFT framework and to consider how to best address the action items from the Action Plan. The consultants then worked with the AML/CFT Regulators and LEAs to consider the way forward.

As a result, a large number of new laws and regulations were introduced, and significant amendments were made to the existing laws and regulations. These included, among others:

- Amendments in Anti-Money Laundering Act, 2010

- Amendments in Anti-Terrorism Act

- Amendments in Foreign Exchange Regulations Act

- Amendments in UNSC 1948 Act

- Amendments in Limited Liabilities Act

- Enactment of Mutual Legal Assistance Act

- Enactment of Rules for CDNS Supervisory Board

- Enactment of AML/CFT Sanctions Rules, 2020

- Enactment of Regulations of Oversight body for SRBs

- Enactments of Regulations for Accountants

- Enactments of Jewelers and Real Estate

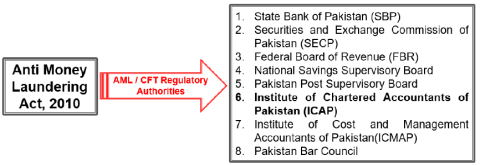

Of these, the most significant legislative step was the amendment of the Anti–Money Laundering Act of Pakistan (the AML Act, 2010). As a result of that amendment, several Authorities and Organizations were designated as AML/CFT Regulators of Pakistan pursuant to the Act. ICAP, as well as the Institute of Cost and Management Accountants of Pakistan (ICMAP), was designated as an AML/CFT Regulator under the Act.

Image

These designated AML/CFT regulators formed a core part of the emergent national architecture. In addition to the Secretariat mentioned above, the national architecture also included a new National Executive Committee of AML/CFT Regulators and LEAs, which was established to ensure continuity of the process and to have effective monitoring of the Action Plan. On an operational level, various other committees were formed by the Government, such as the Supervisory Coordination Committee, comprised of the AML/CFT Regulators. ICAP, in its new role as AML/CFT Regulator, became an active member of this important committee. Finally, in order to interact directly with FATF and APG and to address their queries, an AML Core Engagement Team was formed. ICAP was assigned the role of managing the engagement with the FATF and APG related to Accountants.

As a result of the intensive efforts across Pakistan to implement its Action Plan, the country saw significant improvement in its 2022 follow-up assessment, moving to compliant or largely compliant for 38 of the 40 FATF Recommendations. The Action Plan was deemed completed in June 2022.

Image

In September 2022, the FATF and APG conducted an onsite visit to Pakistan to confirm the completion of the Action Plan, which ultimately led to the removal of Pakistan from the FATF Grey List in October 2022.

ICAP as AML/CFT Regulator: Structure and Program

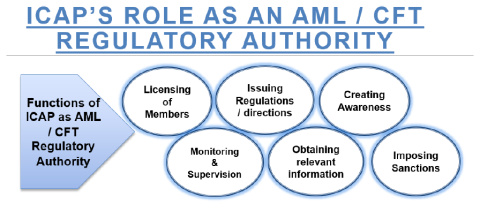

Image

ICAP took on a leading role within the Designated Non-Financial Business and Professions (DNFBPs, including accountants, lawyers, dealers in precious metal and stones, and real estate brokers) in establishing an AML/CFT compliance framework that met the requirements of the FATF-driven reforms in Pakistan. The core components of the new framework established by ICAP included:

- Establishing a comprehensive Risk Based Supervision Framework

- Launching an off-site monitoring program for reporting firms based on an automated online system

- Developing an automated risk matrix program for assessing ML/TF risk of reporting firms based on filings submitted through the off-site monitoring system

- Complementing off-site monitoring with a robust on-site supervision program.

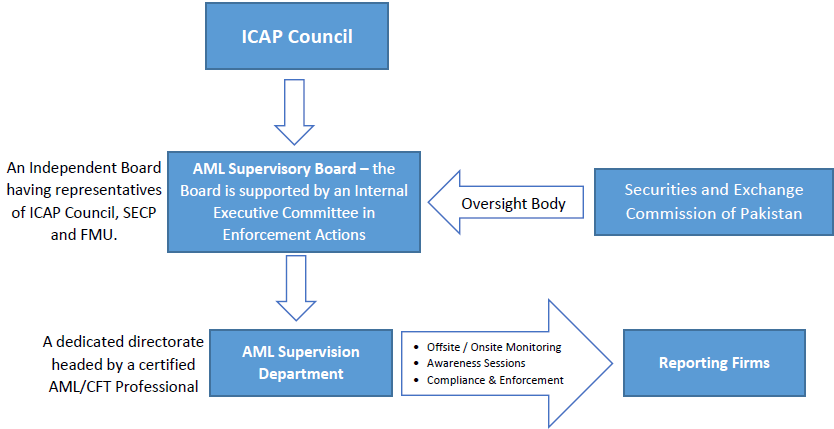

In addition to this core supervision framework, ICAP made significant structural changes to appropriately govern these new regulatory responsibilities. This included a new AML Supervision Department, which consists of four staff as of August 2023. The work of the AML Supervision Department is overseen by an independent Board (“AML Supervisory Board”), formed for that purpose. The Board consists of five members, with representatives from the ICAP Council, Securities and Exchange Commission of Pakistan (SECP) and Financial Monitoring Unit (FMU).

Image

Finally, ICAP established an Internal Executive Committee to assist the AML Supervisory Board for carrying out the Enforcement Action in accordance with the approved ICAP Enforcement Policy.

In discharging its AML/CFT regulatory responsibilities, ICAP implements a risk-based approach (RBA) to supervision. Effective risk–based supervision entails the identification and analysis of ML / TF risks, both at sector level and at an individual firm level, and the application of supervisory attention commensurate with that risk. The supervisory efforts and resources of ICAP are focused primarily on the reporting firms that present higher ML/TF risks, while maintaining appropriate levels of engagement with those with lower risks. This graduated approach ensures the most effective allocation of supervisory resources targeted towards those entities that present the greater risk.

The frequency and comprehensiveness with which the activities on this continuum are applied to reporting firms within the supervised population is aligned with the assessed risk. Low risk reporting firms are subject to only exception-based monitoring, while higher risk reporting firms are subject to proactive supervision and inspections.

Member Education and Global Engagement

The final—and perhaps most important—component of the ICAP AML/CFT framework is members’ education. ICAP embarked on an extensive program of more than 20 individual awareness sessions from 2019 to 2022. These sessions reached over 1000 ICAP members and featured expert speakers from various AML/CFT Regulators and LEAs.

ICAP has launched a dedicated section within the ICAP website which includes relevant rules, regulations, FAQs, video tutorials, etc. related to AML/CFT compliance. This includes comprehensive guidelines on AML/CFT compliance for its members, developed in partnership with outside consultants. ICAP also operates a dedicated email address and phone line to address member’s queries in an efficient manner.

On the global level, ICAP is levering its experience to support other Professional Accountancy Organizations around the world engage with AML/CFT reform and play a positive role in their jurisdictions. Regionally, ICAP is playing a significant role in the South Asian Federation of Accountants (SAFA), where ICAP currently holds the Chairmanship of the SAFA AML Committee. In this capacity, ICAP is providing valuable support to PAOs in the region regarding the obligations under FATF recommendations.

More globally, ICAP has been active in sharing its experiences with PAOs, particularly in the Africa region. ICAP participated in the Pan African Federation of Accountants “Grey List” discussion event in May 2023, and has more recently engaged in direct discussions with leaders of African PAOs in jurisdictions on the FATF Grey List. ICAP is happy to share its experiences with PAOs around the world and hopes this case study is a helpful resource and conversation starter.