Building accountants’ data capabilities is the key to unlocking their future relevance. The various case studies we have heard at IFAC’s Professional Accountants in Business (PAIB) Advisory Group on the rapidly changing role of finance functions all show how finance and accounting professionals have elevated their contribution as business partners through bringing data-driven insights to the decision-making table. For example, data analytics provides accountants with a big opportunity to enhance the quality of audits.

The digital and data revolution of business and society also offers exciting career options. Accountants undertake many different roles in private and public sector organizations and will work with data in different ways depending on their positions. The scope for stewardship and business partnership using data is vast.

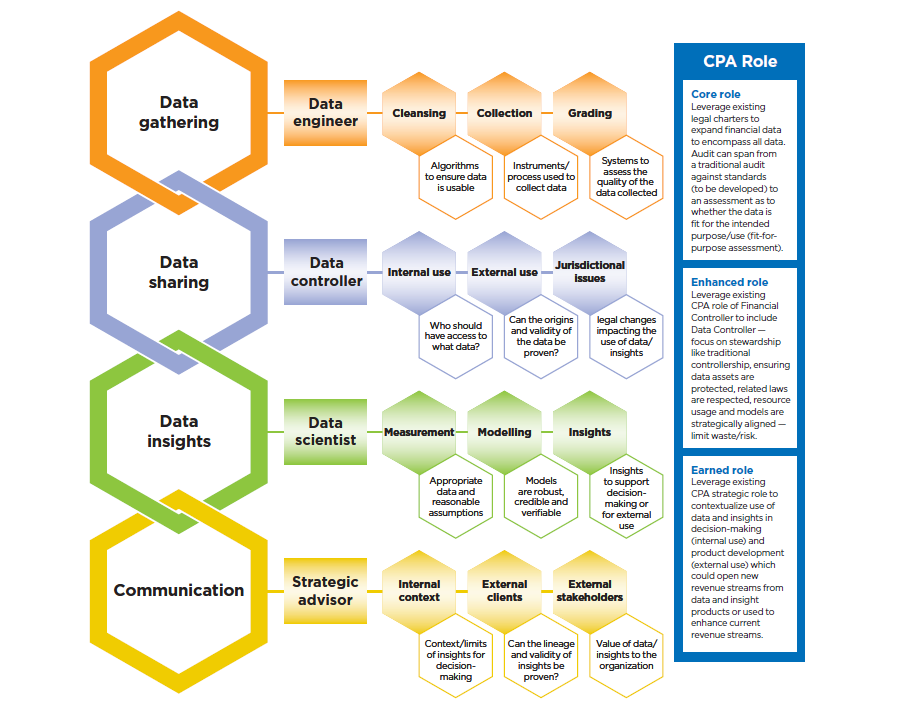

To help professional accountancy organizations (PAOs) and the over 3.5 million professional accountants worldwide, IFAC and CPA Canada developed a data management value chain to capture how the expertise of accountants can be applied in four different areas – as data engineers, data controllers, data scientists and as strategic advisors:

- Data Engineer: in the data gathering phase to ensure data has integrity, is clean and reliable

- Data Controller: ensuring the stewardship of data resources in the data sharing phase in the same way as the existing controllership role covers the stewardship of financial and physical resources

- Data Scientist: to provide insights through the analysis and interpretation of complex data to support decision-making

- Strategic Advisor: as an effective communicator, analyzing and explaining complex business issues within a local, national or global context based on the strengths and limitations of the data, and on the assumptions and models that underpin derived insights.

This value chain approach highlights all the relevant processes that begin when data is first created and collected and extends to transforming, analyzing and communicating data so that users can glean robust actionable insights.

The approach does not necessarily imply that an accountant needs to be a data engineer or scientist, but in certain roles they will need greater data engineering or science related-skills in order to ensure integrity and to derive insights from data that improve understanding and decision making.

An accountants’ role needs to focus on ensuring data is well-managed and then used for strategic advantage. Although making investments in the underlying technology and tools to become more data-driven can be an important step, huge investments in technology can disappoint where the business problem that needs solving has not been clearly defined. This is where finance teams need to enable the value of data.

The discussion paper, The Professional Accountant’s Role in Data, highlights how accountants contribute in these four areas to enable trusted data-driven strategies and decision making. The paper includes case studies highlighting how professional accountants in different roles, such as the CFO or controller, can broaden their roles in driving data-driven decisions. CFOs, finance functions and internal audit functions, as well as accountancy firms, are significantly increasing their capacity in these areas to add greater value as business partners.

Business is facing chronic skills shortages in many aspects of data, and professional accountants can fill these roles. It is a natural evolution of the accountant’s skillset which has traditionally been applied to financial data to measure and analyze financial performance for decision-makers. Their professional foundation provides accountants an exceptionally strong footing on which to fulfill data-roles.

However, professional accountants need to continually adapt to supplement their existing professional competencies with the additional skills and knowledge required to fulfill key roles in the data management value chain. For example, working with non-financial and unstructured data from different sources is new, or more challenging, territory.

The traditional role of accountants has predominantly involved structured data that is manipulated in tables and in Excel, and when it comes to financial reporting, is subject to standards. The valuation of an organization’s data assets will typically show unstructured and non-financial data holds enormous value to a business. Ensuring that this information flows through the finance function is critical if the function is to reveal what is driving revenues, costs and profitability.

Accountants will need to enhance their capabilities in various areas, including statistics and modeling, and blend this with their in-depth understanding of an organization to identify the relevant opportunities and risks. They will also need to understand how decisions are made and be prepared to address bias and other human factors in decision-making.

PAOs should also consider their involvement in the development of data standards and legal frameworks to govern the digital economy. Global and national regulators are increasingly focused on regulating digital platforms and the use of private data. The current lack of standards and clear legal and regulatory environment is likely to impede the potential of big data and digital transformation at least to some extent.

In Canada for example, the Government has engaged different standard-setting bodies and stakeholders, including the CPA Canada, to develop governance and standard-setting arrangements around data-gathering and usage. PAOs have an opportunity to get involved in these activities providing the profession’s expertise in standard-setting and in data. At the same time, accounting standards also need to evolve to better address digital data.

Data management value chains are about creating data-driven outcomes with confidence whether it be exploring new products or strategies. As elements of traditional accounting roles become less relevant, the data management value chain provides helpful insights into how professional accountants deliver value in new areas and roles.