Takeaways from the Professional Accountants in Business Advisory Group's Meeting

With the myriad of opportunities available to accountants across positions, locales, and sectors and with the ability to progress in many different roles, accountancy is a passport to meaningful and rewarding careers in both the private and public sectors. This was the theme of the latest meeting of IFAC’s Professional Accountants in Business Advisory Group (PAIBAG) held in New York City, which convenes a global and diverse group of professional accountants working in a variety of leadership positions in business and the public sector.

Over a fantastic 2-day meeting, our discussions focused on the long-term value accountants create and the positive impact they have. We heard how finance leaders and their teams are elevating their strategic and value contributions to both the organizations they work for and to wider society. By enabling digital transformation, connecting organizational goals to corporate sustainability targets and the sustainability development goals (SDGs), and by helping to manage short and long-term trade-offs, professional accountants are contributing to more resilient and sustainable organizations and economies.

We explored five critical priorities for the profession which provide exciting opportunities to those choosing accountancy career pathways in business or the public sector.

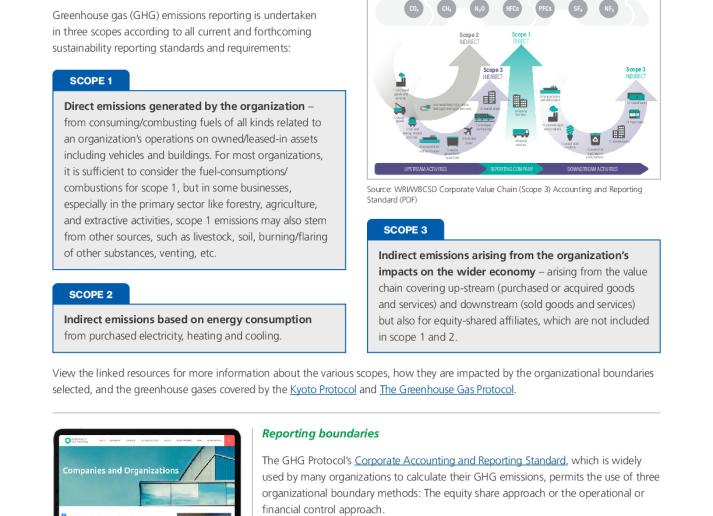

1. Championing organizational sustainability agendas including how accountants in CFO, finance function, controller, internal audit, and treasury positions arefacilitatingnet zero transitions, supporting climate risk management, and helping organizations prepare for mandatory sustainability-related disclosure and assurance requirements.

Lynda Heywood, Group Treasurer, Tesco, a leading multinational retailer, highlighted how Treasury is involved in actions to deliver Tesco’s commitment to be carbon neutral across Group operations by 2035 and net zero across the full value chain by 2050. For example, Treasury has delivered sustainability-linked financing in the form of a revolving credit facility and sustainability-linked bonds. In addition, as 90% of Tesco’s emissions footprint lies within its value chain, Tesco, in partnership with various banks, has become a leader in supply chain finance to reduce indirect scope 3 emissions by linking funding costs for suppliers to sustainability performance.

Yulanda Chung, Head of Sustainability for Institutional Banking Group, a Singapore DBS Bank and the largest bank in Asia by assets, shared its 2050 net zero commitment and how it is actively shifting its portfolio to work with companies in 9 sectors to establish decarbonization pathways that bring about science-based emissions reduction targets and improve data to better target investments in solutions.

Cindy Ngan, a Partner in Climate and Sustainability at PwC Hong Kong, highlighted the links between achieving net zero at the same time as achieving other sustainable development goals. She also outlined PwC’s framework for helping companies think about the key elements for success on a net zero transformation.

Eight key takeaways for the accountancy profession emerged from the discussions:

- Engagement with governments and policymakers is critical in the context of a ‘just transition’

- Clear and effective corporate governance must be established

- The consequences and cost of inaction can be used as a business case for decarbonization and sustainability

- Finance and accounting professionals have a significant role in net zero and sustainability

- A key focus is on securing the data and insights to enhance decision making

- Larger companies can play a key role in influencing supply chain partners

- Reporting and disclosure need refinement and standardization

- Education, upskilling and talent management are top priorities

2. Transitioning the role of Chief Finance Officer (CFO) to Chief Value Officer (CVO) for increased organizational value by embracing realities of our environment that impact businesses, shifting the corporate conversation towards long-term strategic value creation and optimizing the opportunity to positively influence all key stakeholders.

For finance professionals to transition to CVOs, championing an integrated mindset is key. The integrated mindset leads to a comprehensive multicapitals approach to planning, measurement and reporting, and connects the business model to all relevant value drivers. Bikash Prasad, Group CFO of Olam Agri, highlighted what this evolution involves for the finance team in Olam, as well as Olam’s approach to engaging and inspiring their finance professionals. For further insights on Olam’s journey, see: The Transition to a Chief Value Officer – An Opportunity for Finance and Accounting Professionals.

One of the biggest barriers to professional accountants elevating their role as strategic business partners is developing leadership and professional skills. Accountants can often prioritize developing their technical skills and focus less on acquiring the skills needed to influence and become effective finance business partners. Caroline Stockmann, CEO, Association of Corporate Treasurers (ACT), highlighted how the ACT is providing relevant and innovative training and development opportunities to its members based on a competency framework that helps develop the right skills and knowledge needed to drive team and business performance.

3. Evaluating finance talent models and career pathways, particularly in Global Business Services (GBS) and Finance Shared Services (FSS) which are large employers of accountants worldwide.

With contributions from Jamie Lyon (Global Head of Skills, Sectors and Technology, ACCA), Deborah Kops (Sourcing Change) and Shirley Hung (Partner at Everest Group), we explored GBS and FSS career pathways and opportunities. FSS and GBS are moving to new operating models that leverage automation and digital tools and the creation of end-to-end processes based on employee and customer lifecycles to create higher levels of value. As they transform and increase their scope, there is a need for accountants to become process owners who are experts in different areas and who can foster continuous improvement.

Key messages

- GBS/FSS environments can provide the opportunity for accountants to be more globally mobile, but barriers remain, particularly in terms of where delivery locations are based, proximity to head offices or the regional hubs where key FSS/GBS leaders reside.

- There is a need for the accountancy profession to better promote GBS/FSS career opportunities for professional accountants in business.

READ MORE: Global Business and Finance Shared Services Offer Rewarding Career Opportunities to Accountants

4. Expanding the global pool and attractiveness of the profession to meet the fast-growing demand of the corporate world by encouraging collaborative professional apprenticeship programs to be developed and implemented globally to support access into the profession.

As accountants, we know firsthand the benefits the profession provides, and we are gathering insights from our global community on how to ensure others understand the value, impact, and ability of accountants to become influencers and leaders in organizations.

ACCA: Global Talent Trends 2023

With 8,405 responses across 148 countries, ACCA’s recent study on the future of work and careers in the profession revealed 7 key themes:

- Inflation crisis fuels wage pressures

- Hybrid work is “work in progress”

- Addressing burnout has to be a priority

- Mobility is driving a possible talent crunch

- Technology is empowering, but concerns prevail

- Inclusivity measures score well, but social mobility lags

- Accountancy provides career security in turbulent times

Read the full report here: Global talent trends 2023 | ACCA Global

We discussed how professional apprenticeship schemes can be developed to meet the demand for practical finance and accounting skills such as the Apprenticeship for Finance Business Partners program launched by the AICPA and registered with the US Department of Labor. Apprenticeships increasingly provide vocational professional upskilling opportunities that can meet the needs of economies and address talent management issues facing CFOs and their finance teams. Apprenticeships also provide more opportunities for those considering accountancy as a rewarding career pathway in business.

Apprenticeship Pathways: An Opportunity to Widen Access into the Accountancy Profession

There are a number of different pathways needed to attract and retain talent in the accountancy profession to meet the increasing market demand for finance and accounting professionals. An apprenticeship approach can offer huge opportunities for PAOs, employers and individuals. The PAIB Advisory Group identified key success factors for establishing and maintaining an effective apprenticeship model, which included:

- A clear value proposition supported by a branding and marketing campaign

- Government engagement and support

- Strong partnership between PAOs and employers

- Incorporation of different learning styles

- Effective PAO oversight and support

READ MORE: Apprenticeship Pathways: An Opportunity to Widen Access into the Accountancy Profession

5. Supporting the growth of accountants in the public sector. Many jurisdictions at central and local government levels experience difficulties in finding suitable candidates with the right skills for finance and accounting positions.

To address these shortages, help drive public financial management reforms, and respond to the future needs of the public sector, there is an important need and opportunity to increase professionalization in public sector finance, and to support public sector accountants with challenges such as corruption and intimidation.

To highlight the crucial role of PAOs in the public sector, we heard a case study from the South African Institute of Chartered Accountants (SAICA).

Milton Segal, SAICA’s Director of Standards, and Natashia Soopal, Executive in SAICA’s Ethics Standards and Public Sector, presented on their organization’s efforts to enhance the marketability of public sector accounting careers and efforts to support and encourage the advancement of skills, knowledge and competencies to ensure SAICA members are positioned to contribute to the economic and social advancement of South Africa.

Alison Bonathan, Technical Manager at the Chartered Institute of Public Finance and Accountancy (CIPFA) also presented on CIPFA’s Corruption Prevention Programme and International Certificate in Corruption Risk Management to respond to corruption risk in the public sector.

Actions for PAOs to support the public sector

- Promote the value that a professional finance workforce brings to public sector priorities, across a diverse range of roles.

- Advocate for the importance of having accountants in key positions in government departments to ensure proper management of public funds.

- Engage with key influencers in the public sector.

- Support professionalism and continued professional development of the public finance workforce, including development of broader skills such as business partnering and influencing.

- Collaborate with key stakeholders (such as governments and donor agencies) to support PFM reform programs, including supporting implementation of accrual IPSAS.

- Highlight the breadth of opportunities a career in public sector accountancy provides, including opportunities to make a difference to broader economic, societal, and environmental issues.

With the opportunities ahead of us, there has never been a better time to be an accounting and finance professional. In a complex world with growing variables, uncertainties and new business and economic dynamics, the growth, development, and evolution of the profession are critical to driving sustainable prosperity. After all, ‘accountancy’ is the global language for business, and we need to meet the increasing demands for finance and accountancy skills from our multiple stakeholders, including society at large.

To be sure not to miss our learnings, follow IFAC on LinkedIn and subscribe to the mailing list for updates.