Professional Accountants in Business (PAIB)

Sustainable Organizations & Sustainability Transformation

As Deputy Chair of IFAC’s Professional Accountants in Business (PAIB) Advisory Group, at our March 2023 meeting, I moderated a panel of experts to explore how financial institutions and companies are approaching their net zero transition planning, key priorities and trade-offs, and how CFOs, finance and treasury functions can support them. Eight key takeaways emerged for the accountancy profession and its role in enabling capital markets and societies to deliver sustainability goals.

The panel included:

- Yulanda Chung, Head of Sustainability, Institutional Banking Group, Singapore DBS Bank

- Lynda Heywood, Group Treasurer, Tesco PLC (Lynda also presented on Tesco’s Net Zero journey and the role of the finance and treasury function)

- Cindy Ngan, Partner, ESG-Climate and Sustainability, PwC Hong Kong

1. Engagement with governments and policymakers is critical in the context of a just transition.

- Ongoing engagement with governments is critical to achieve sustainability objectives and ensure private sector and political alignment on achieving net zero and decarbonization. Without strong political leadership and government intervention, financial institutions and companies will struggle to achieve net zero, particularly in their value chains. National policy, frameworks and incentives linked to the UN Sustainable Development Goals (SDGs) and the global Paris Climate Agreement of 2015 provide companies with a clearer roadmap to setting and meeting their own long-term climate and sustainability goals.

- The role of sovereigns and financial institutions in plugging the funding gap with sustainable debt finance is critical in enabling transition. For example, DBS, one of South East Asia’s leading banks, provides a range of financing opportunities as part of its own net zero 2050 strategy particularly targeted at high-impact sectors. However, government incentives and support are necessary to enable companies to invest in sustainability programs, particularly where private financing is not commercially viable to support transition and adaptation. Governments can also play a critical role in engaging and facilitating Charities and Foundations in providing support to NGOs in initiating the net zero journey.

- A “just transition” is a strong focus in many parts of the world to ensure that no-one is left behind in efforts to achieve a net zero economy and sustainable development. This involves understanding the interconnectivity and tensions between environmental, social and governance (ESG) issues and maximizing the socioeconomic benefits of decarbonization while minimizing negative impacts, for example, in relation to economic development where people and communities are dependent on high-emitting sectors. New jobs in green supply chains may also involve new environmental and social risks. In Asia, there are many development needs related to the SDGs, and in terms of climate, there is greater exposure to physical risk associated with the effects of climate change. Consequently, it is important for companies to take into account the sustainability impacts and priorities of the different regions and jurisdictions they operate within.

2. Clear and effective corporate governance must be established.

- Clarity on the roles and responsibilities of the board and its sub-committees is important to ensure effective oversight of sustainability and ESG. An integrated mindset at the board level requires coordination of and connectivity between the board and other board committee agendas including but not limited to the audit committee, the nomination and remuneration committee, and sustainability committee (if one has been established). But ultimate accountability still rests with the board for establishing and achieving sustainability goals and selecting net zero consistent pathways while taking into consideration the needs of, and impacts on, key stakeholders including customers, suppliers, employees and society.

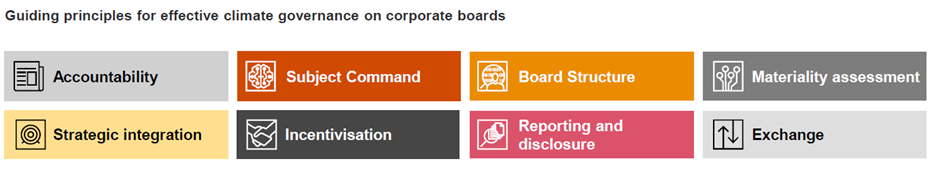

- PwC has developed a Climate Governance Maturity Framework that builds on The World Economic Forum’s Guiding Principles on How to Set Up Effective Governance on Corporate Boards to help board members practically assess their organization’s approach to climate governance.

- Audit committees should be, and are increasingly, providing oversight of sustainability-related disclosures in mainstream corporate reports and regulatory filings to ensure trust in such disclosures and enhance investor protection (see Key Questions for Audit Committees Overseeing Sustainability-Related Disclosure).

3. Use the consequences and cost of inaction as a business case for decarbonization and sustainability.

- Understanding the risk and future cost of inaction versus the benefits and cost today of taking action to achieve net zero and sustainability ambitions helps to clarify the business case and drive business commitment. Financing a low carbon and sustainable future will become increasingly more costly as externalities such as carbon become more expensive.

- Long and medium-term targets provide clarity on the long-term direction of travel toward net zero while allowing flexibility in the short term to deal with immediate challenges. For example, CFOs are navigating short term challenges such as inflation and interest rate rises, commodity price increases, energy security and supply chains.

- Finance and accounting professionals can advise on the opportunities that exist in many countries where governments and financial institutions are providing financing for investments in decarbonization and sustainability initiatives. For example, the US and the Inflation Reduction Act provides subsidies for a range of decarbonization technologies beyond wind and solar including carbon capture, sequestration and hydrogen.

4. Finance and accounting professionals have a significant role in net zero and sustainability.

- The role of finance and accounting professionals is critical particularly in terms of the link between net zero and sustainability transition mechanisms and the cost of financing. In collaboration with sustainability experts and operational colleagues, finance and accounting professionals can use their professional skillset to establish effective governance and processes, understand and quantify climate risk relating to realized and unrealized emissions, and the cost and benefits of finance and options to improve ESG and business performance.

- Finance and accounting professionals have an important role in ensuring the relevant data is available for decision making and that sustainability priorities are incorporated into business processes through budgeting and forecasting, capital allocation, performance assessments and scorecards. On the reporting side, their ability to conduct materiality and reporting assessments and build trust in data and reporting processes is key (see How COSO’s New Sustainability Reporting Guidance Provides Opportunities for the Profession.)

- New roles such as the ESG controller are being created to help companies prepare for new requirements for sustainability-related disclosure and assurance. ESG controllership is typically incorporated into the remit of the finance function. Unilever sets an example by bringing the financial reporting professional skillset to sustainability reporting to enhance trust in the data and reporting process to enable decisions and disclosure. PwC has also highlighted What ESG Controllers Do.

Sustainable Debt and the Role of Professional Accountants in Business and the Public Sector

This joint IFAC/BMO paper explores what investors and banks need from companies and how finance and treasury professionals enable sustainable financing and support sustainable supply chains that prioritize actions and incentives to collectively meet targets.

5. Enhance decision making with effective data and insights.

- Financial institutions and companies are focused on the data and information needed to drive decisions and relevant KPIs to steer them toward establishing and achieving relevant targets, and responding to stakeholder demands. A key focus is on securing the data and insights needed to evaluate decisions. For companies this includes GHG emissions arising in their value chains, which for many can constitute most of their footprint, and working with suppliers and customers to find solutions that reduce scope 3 emissions to help meet climate goals. Project net zero at DBS includes developing an ESG data architecture and data repository to capture the relevant GHG emissions profile of client companies. This enables their climate risk assessment to reduce credit and financial risk, and to conduct climate scenario analysis and stress tests.

- Finance functions are therefore increasingly focused on data collection, traceability, measurement and modeling, and verification. This involves breaking down silos and creating effective finance business partnerships to measure and report on what has already occurred as well as using technology and digital tools to enhance real-time information flows and forward-looking projections to make decisions on how to mitigate and adapt to sustainability risks and opportunities and gain competitive advantage. Some finance functions are taking the lead on pricing climate risk and incorporating carbon budgets and other relevant targets and KPIs into decisions and investments.

- Companies and finance functions value guidance and tools such as maturity assessment models to enable them to evaluate and self-assess where they are on their net zero and/or sustainability journey in terms of establishing baselines, targets and strategies, communicating objectives, actions and progress.

6. Larger multinational companies can play a key role in influencing supply chain partners.

- Large companies are well-placed to support small-medium sized organizations (SMEs) in their supply chains by providing financing to enable them to decarbonize and achieve sustainability targets, particularly for scope 3 emissions reductions. For example, the Tesco PLC supply chain finance program is enabling a group of suppliers to access lower cost financing to support investments in new initiatives and capital expenditure, and Tesco is also providing learning tools to help SMEs focus on their most significant sustainability-related risks and opportunities.

7. Refine and standardize reporting and disclosure.

- Achieving global consistency and comparability of sustainability-related disclosure should be driven by adoption of The International Sustainability Standards Board (ISSB) General Sustainability-related Disclosures (S1) and Climate-related Disclosures (S2) which are based on the structure of The Task Force on Climate-related Financial Disclosures as recommended by the Financial Stability Board group. ISSB standards will be effective for annual reporting periods beginning 1 January 2024. However, enhancing the comparability of disclosures would ideally require a standardized reporting format as well as methodology to help companies consistently report key pieces of information about their business and sustainability performance in a connected way. A standardized corporate reporting format or template would also be beneficial to finance teams in their efforts to automate and standardize internal and external reporting processes to adhere to mandatory sustainability-related disclosure and assurance requirements.

The ISSB launched a consultation on its priorities to inform its two-year work plan and to request feedback on a potential project on integration in reporting. This would look at reporting on interdependencies, synergies and trade-offs between a company’s own resources and relationships. The project would also examine if and how the ways in which the value a company creates for itself is inextricably linked to the value it creates for other stakeholders, society and the natural environment. These links could create opportunities for progressing integrating reporting via the connection of sustainability-related disclosures with financial statements. This consultation will be an important opportunity for the profession to shape the ISSB’s agenda in the coming years.

- Developments in reporting and disclosure all highlight the importance of transition planning and decision-useful information for the capital markets. Investors strongly support clarity on how companies intend to achieve their emissions reduction targets and progress made. The ISSB’s proposed standard, S2, on Climate-Related Disclosures includes a requirement to disclose “the effects of significant climate-related risks and opportunities on its strategy and decision-making, including its transition plans.” Transition plan disclosure is also an element of the EU’s standards on sustainability reporting under the new Corporate Sustainability Reporting Directive, as well as specific jurisdictional initiatives like the SEC proposals in the US and the UK’s Transition Plan Taskforce proposals. Transition plan disclosures should also include other relevant targets and initiatives related to the connectivity between decarbonization and ESG factors such as nature and biodiversity.

8. Prioritize education, upskilling and talent management.

- Contributing to sustainability solutions in business is a way for companies to attract and retain finance talent.

- The professional accountant’s skillset is needed in various areas, including enhancing trust in data and reporting processes and connecting net zero and sustainability ambitions to the achievement of targets. In addition, finance and accounting professionals need to understand transition pathways and solutions and how they enable transition planning in their organization. Accountants must be given opportunities to learn the language of climate change and sustainability from scope 1-3 emissions, transition and physical risks and sustainable-linked financing. Relevant sustainability education and training opportunities will enable them to identify climate and sustainability risks and solutions, and embed ESG and sustainability priorities into strategy, risk management, financing and internal and external reporting processes.

IFAC and professional accountancy organizations have an important role in driving sustainability literacy as part of the profession’s overall efforts to support professional accountants and ensure the profession has visibility and voice in strategic forums such as the United Nations Climate Change Conference. With these goals in mind, we should also consider involvement in forums for other professionals where accountants have not traditionally been involved but would undoubtedly make an impact.