On June 2, 2025, the International Federation of Accountants hosted the MOSAIC (Memorandum of Understanding to Strengthen Accountancy and Improve Collaboration) Forum under the theme of Strengthening Accountability through Collaboration at the UK National Audit Office on Buckingham Palace Road in London. The annual Forum was held alongside the INTOSAI Capacity Building and Donor Cooperation Committee meetings and MOSAIC Steering Committee meeting. This format creates the opportunity to facilitate engagements between representatives from the accountancy profession, Supreme Audit Institutions, and the donor community and provides an avenue for these organizations to collaborate on strengthening public institutions through improved public financial management (PFM) and sustainability reporting standards.

“We must be deliberate in driving meaningful conversations on public sector professionalization — not as a matter of coincidence, but as a central reform priority,” said South Africa’s Auditor-General, Tsakani Maluleke. “These discussions need to translate into feasible action that will bring about the changes we need.”

Introductory Remarks

IFAC MOSAIC Forum 2025 | Welcome Remarks

Kate Mathers of UK National Audit Office kicked off the Forum, speaking about the important role accountants and auditors play in society. “Today’s meeting brings together people who share a powerful belief: that financial reporting is not just a technical exercise. It’s the cornerstone of transparency, accountability, and public trust.” With public sector financial reporting and audit facing challenges related to capacity building and resource management, emerging technology and non-financial reporting, Mathers pointed out that it’s important to have events like the MOSAIC Forum to build on existing momentum and expertise.

Lee White, IFAC CEO, emphasized that from the rich conversations that would happen later that day, action must follow. “This isn’t just about the conversation today, but about how the prominence of today’s conversation continues in our actions,” he noted.

Tsakani Maluleke, the INTOSAI Capacity Building Committee Chair, followed White. Maluleke is the Auditor General for South Africa and is a member of the South African Institute of Chartered Accountants. She emphasized the importance of PAOs in developing well-trained professionals for both the public and private sector. She highlighted that there is a need to create opportunities for young people to participate meaningfully in the economy and, importantly, to earn a stake in the democracies they are part of.

Panel 1: Sustainability Reporting in the Public Sector

Three panels followed the introductory remarks. The first, with panelists Ian Carruthers (IPSASB), Srinivas Gurazada (World Bank), Archana Shirsat (IDI), Simon Thompson (Global Capacity Building Coalition) and moderated by Lee White, tackled Sustainability Reporting in the Public Sector.

Ian Carruthers started things off with IPSASB’s recent sustainability standards journey. 700 people from around the world participated in roundtables for IPSASB’s initial public sector sustainability reporting exposure draft; IPSASB ended up with 96 written responses. When asked about the nature of the responses, Carruthers mentioned that IPSASB proposed going off the baseline developed by the International Sustainability Standards Board (ISSB), but underlining that the public sector is different because of its ability to influence economies through regulation, grant funding, etc. He said that the idea of basing public sector reporting off the ISSB’s S2, with relevant elements of S1, was well received. Operationalizing the standards, responses noted, needed more thought.

On the same panel, Srinivas Gurazada spoke about the World Bank’s commitment to support climate reporting. With 2024 being the hottest year in history, Gurazada said: “There is no other option but to make progress. That’s why the World Bank’s goal evolved into ending poverty and boosting shared prosperity in a livable planet.” To succeed, the World Bank targets having climate co-benefits of 45% in all of its funding activity. It creates tools like the Country Climate and Development Reports and Country Climate Change Institutional Assessment (CCIA). The PEFA Climate framework, developed by the PEFA partnership, is a transformative initiative to enable governments mainstream climate responsiveness in budget processes. It complements IPSASB’s Sustainability Reporting Standards.

Archana Shirsat spoke about coming to the discussion of sustainability reporting in the public sector as a public sector auditor. “Sustainability is not new to the public sector. For a very long time, we spoke about sustainability only in the context of environment.” Just the “E” of “ESG”, in other words. This changed with the emergence of the UN’s Sustainability Development Goals, when it became clearer that environmental goals intersected with so many other elements of society. Shirsat said that with the SDGs, the ways SAIs did whole-of-government audits changed drastically to be more intersecting and understood more holistically. “The area of sustainability reporting must be looked on the terms of assurance and compliance, but also—are the outcomes being achieved for the benefit the people?” She mentioned that the SAI community now needs to understand the landscape and the context of their work. SAIs in developing jurisdictions will be operating in a very different context than others. She added that having robust public sector professionals and institutions is essential to having the ability to embrace the complexity needed for sustainability reporting.

Simon Thompson explained that the GCBC came to exist because no one should be left behind when it comes to climate and sustainable finance. “[The GCBC doesn’t] do capacity building; we aim to convene and coordinate the major funders of capacity building.” For the GCBC, capacity building is not the goal, it’s the means to an end. Emerging markets require money to grow. Accountants are vital to this growth, Thompson explained, through financial reporting and disclosure, CFOs championing sustainability in the boardroom, and the crucial role of accountants at SMEs. The public sector provides the infrastructure for deploying private finance and influences behavior across economies. When these variables come together, great work happens but it can fly under the radar. The GCBC is attempting to address this with two initiatives. First, they have created a Knowledge Hub, where frameworks, toolkits, train-the-trainer materials, and more can be found in one place and searched by users’ unique needs. Second, they’ve launched the GCBC Accelerator to spotlight important work in high-impact capacity building in the world. The deadline for applying to the Accelerator is July 4, 2025.

Panel 2: Strengthening Accountability through Collaboration

In the second panel, Strengthening Accountability through Collaboration, the focus turned to the effort to professionalize the accountancy profession in the public sector. The panel members included Tsakani Maluleke (INTOSAI CBC), Timothy Mkandawire (African Development Bank) Meisie Nkau (AFROSAI-E) and Jelena Misita (IFAC PAO Development Advisory Group). The panel was moderated by Darlene Nzorubara of IFAC.

Jelena Misita pointed out that professional accountancy organizations can be—often are—essential players in their economies. “PAOs are key drivers of progress, enabled by strong partnerships. Donors play a pivotal role in catalyzing change, while PAOs build and sustain capacity. Above all, the most crucial aspect of public financial management is people. Competent and ethical professionals are essential for delivering a lasting impact and building public trust.”

Timothy Mkandawire added that public financial management systems are the bedrock of public trust and economic resilience. “When a country takes part in PFM system improvement and reform, it allows us to make progress,” he said. He detailed the ways that regional member countries, along with regional and global institutions, work with the AfDB, making such PFM improvement possible. Like Shirsat, he pointed out that each country best understands the landscape they operate in, and sustainable accounting needs will be unique and context-dependent in that respect.

Tsakani Maluleke, who spoke in the introductory remarks about developing trained professionals for the public and private sector, mentioned that professionalization strengthens ethics and integrity in the public sector. “It’s wonderful to have the best auditing and accounting standards on hand, but you rely on professionals to implement them appropriately.” Competent, ethical SAI staff are essential, Maluleke said. She also pointed out that capacity building must be done on the individual and institutional level. She reiterated that in order for an SAI to carry out its mandate, working with the entire ecosystem of the accountancy profession is wise, so that all angles and intersections are considered.

Meisie Nkau mentioned a specific professionalization initiative of AFROSAI-E called the African Professionalisation Initiative (API). “With the help of donors and development partners, the API has been able to strengthen those in the finance units, including auditors and accountants, to give them a professional background in terms of the public sector, and give them the basic knowledge of accounting standards. There have now been two exit assessments in Liberia, so for the first time, API will have a graduation ceremony for Liberian students this July 4.” More countries have similar programs in the works, with their first students anticipated to graduate in the years ahead.

Panel 3: Leveraging Accrual Accounting for Effective Fiscal Oversight

The third panel discussed Leveraging Accrual Accounting for Effective Fiscal Oversight. Panelists again included Ian Carruthers and Srinivas Gurazada, who were joined by Rajesh Kishan (Foreign, Commonwealth and Development Office, UK). Harpal Singh of IFAC moderated.

To shed some light on the importance of accrual accounting, Carruthers clarified that accrual accounting shows what you own and what you owe. “If you don’t understand that, how are you going to be able to project forward and determine how you might best address a crisis?” Carruthers noted, adding that when the public understands how money collected through taxes is being spent, they’re more likely to pay their taxes. If the public does not pay taxes, public services fall apart, eroding trust even more. IPSAS provide public sector-specific standards with principles-based guidance, supporting that critical public trust.

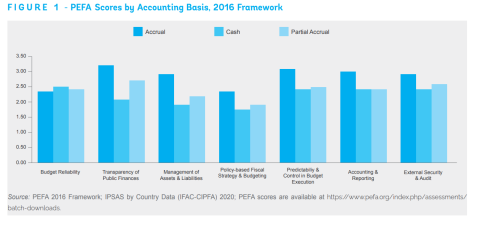

Image

Gurazada spoke about the World Bank’s efforts to show public sector organizations around the world examples of the effects of accrual accounting on PFM scores. “We decided to show people real-world scenarios to help them make their own judgement,” he said, referring to the 2024 Global Report on the Use of Accrual Accounting for Fiscal Management. “We looked at countries that are on PFM scores of countries that use cash, accrual, and partial accrual. Accrual accounting reforms can be expensive and take time. Is it worth it, particularly in World Bank-supported countries, to pursue [accrual accounting]? And of the countries we looked at, the benefits were very significant and we concluded it is a worthwhile exercise to move to accrual accounting.”

Rajesh Kishan, Governance Advisor at the Foreign, Commonwealth and Development Office (FCDO) of the UK, introduced the FDCO’s efforts to introduce governments to a balance sheet approach. The FDCO’s approach raises governments’ awareness of three dimensions: fiscal risk, assets, and liabilities. This awareness is critical considering an increasing prevalence of crises that impact macroeconomic stability. Kishan noted that by letting governments know about different entry points within these three dimensions, the FDCO provides steps for onboarding governments to first resource accounting and budgeting, then accruals accounting, then whole government accounts. “It’s not necessarily about emulating the UK or New Zealand or others. It’s actually about finding the [right] pathway.”

Closing Remarks

IFAC MOSAIC Forum 2025 | Closing Remarks

Jelena Misita closed out the forum. She noted that the theme for the day, discussed in all of the panels, was collaboration. “Throughout today’s discussions, one message has been clear: we can only move forward when we move together. Our collaboration represents a shared commitment to invest in people, PAOs, and the public institutions,” she said. “By advancing the professionalization of the public sector, we are laying the groundwork for lasting trust, accountability, and progress that benefits everyone.”

IFAC sincerely thanks all of this year’s speakers and participants and looks forward to the 2026 MOSAIC Forum.