The International Federation of Accountants today announced that Jörgen Holmquist has been appointed as the first independent chair of the International Ethics Standards Board for Accountants (IESBA), beginning September 2012 for a three-year term. The appointment has been approved by the Public Interest Oversight Board*.

“Jörgen brings a wealth of experience to the position of independent chair of the IESBA,” said IFAC President Göran Tidström. “In his past roles, as well as in his current position as a public member of the IESBA, he has shown strong leadership skills, technical competence, and a commitment to the IESBA and its mission to protect the public interest. I am confident that, under his leadership, the IESBA will continue to make a highly effective contribution to ethics standard setting as well as, importantly, adoption and implementation. I would like also to acknowledge the exemplary contribution and commitment Ken Dakdduk brought to the role, and to his position on the board, over the past seven years.”

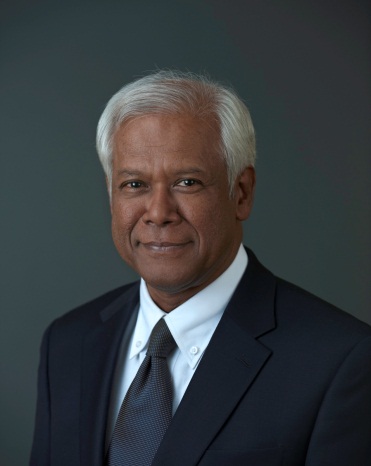

Mr. Holmquist has been a public member of the IESBA since 2011. He served as Director General, DG Internal Market and Services, European Commission from 2007 to 2010, where he was responsible for developing the European Union (EU) regulatory response to the financial crisis, including legislation and policy concerning accounting and auditing. Before joining the European Commission in 1997, he served in the Swedish Ministry of Finance for twenty years. Mr. Holmquist holds a degree in Economics and Mathematics from the University of Stockholm, Sweden and is a Fellow of the Weatherhead Center for International Affairs at Harvard University.

The appointment of an independent chair for the IESBA was recommended by the Monitoring Group in its “Review of the IFAC Reforms — Final Report,” which was issued in 2010.

In his role as chair, Jörgen Holmquist will provide leadership to the IESBA. A key function of the chair is to enable, encourage, and promote a deeper understanding by stakeholders and the public of the strategies and activities of the IESBA. The chair also leads the strategic direction of the IESBA, working closely with IESBA staff, and facilitates the deliberative and consultative processes that underpin the authority of the IESBA and the legitimacy of its standards and activities. In addition, the chair is involved in developing and maintaining effective relationships with national standard setters, regulators, and other key stakeholders.

“Convergence to a single set of high-quality ethical standards will contribute to efficient, sustainable, and vibrant capital markets and is in the public interest,” Jörgen Holmquist commented. "I look forward to advancing the IESBA’s current initiatives, as well as the recently announced additional workstreams, enhancing relationships with national standard setters, regulators, governments, and the public and promoting adoption and implementation of the Code."

*Notes to Editors

The international Public Interest Oversight Board (PIOB) was established in February 2005 to ensure that international auditing and assurance, ethics, and education standards for the accountancy profession are set in a transparent manner that reflects the public interest. The objective of the PIOB is to increase confidence of investors and others that such activities, including the setting of standards by the IESBA, are properly responsive to the public interest. PIOB members are nominated by international institutions and regulatory bodies.

About the IESBA

The International Ethics Standards Board for Accountants (IESBA) is an independent standard-setting board that develops and issues, in the public interest, high-quality ethical standards and other pronouncements for professional accountants worldwide. Through its activities, the IESBA develops the Code of Ethics for Professional Accountants, which establishes ethical requirements for professional accountants. The structures and processes that support the operations of the IESBA are facilitated by IFAC. Please visit www.ifac.org/ethics for more information.

About IFAC

IFAC is the global organization for the accountancy profession dedicated to serving the public interest by strengthening the profession and contributing to the development of strong international economies. IFAC is comprised of 167 members and associates in 127 countries and jurisdictions, representing approximately 2.5 million accountants in public practice, education, government service, industry, and commerce.

# # #