Professionalism starts with people

Liz Fisher, journalist

|The public sector financial reporting reforms implemented since the global financial crisis started in 2008 have largely focused on the shift from cash-based to accruals-based accounting. But in some respects, this is a distraction. Improving the accountability, transparency, governance, and integrity of government revenues and spending requires a multi-faceted approach that encompasses people, systems and processes.

'A professionalised workforce supplies much more than accounting information; it adds value on multiple levels.'

So what does it take to truly professionalise public sector finance functions? A new report from ACCA and IFAC, Professionalisation in public sector finance, sets out the challenges and argues that professionalisation of the workforce is one of the most important aspects of the public financial management (PFM) journey.

The report argues that professionalisation brings credibility, trust and confidence in public finances. It is achieved by increasing the number and capacity of skilled professionals, with suitable training and recognised qualifications, who are members of and subject to regulation by a professional body, are acting in the public interest, and are required to abide by international ethical and professional standards.

This professionalised workforce, when properly resourced and appropriately used, supplies much more than accounting information; it adds value on multiple levels. For example, to the individual it brings development of professional knowledge, technical and soft skills; the ability to communicate complex information in simple terms and to support and influence policymakers; and diverse options for a successful career path.

To governments it brings, among other benefits, access to a trained workforce offering financial management discipline; internationally recognised professional and ethical standards that help reduce fraud and corruption; reliable budgetary control and effective risk management; and better quality information to enable evidence-based decision-making.

And to economies it brings fiscal credibility; transparency and accountability of public finance information; and better use of public funds.

‘In some countries there is a lack of recognition that change is needed at all’

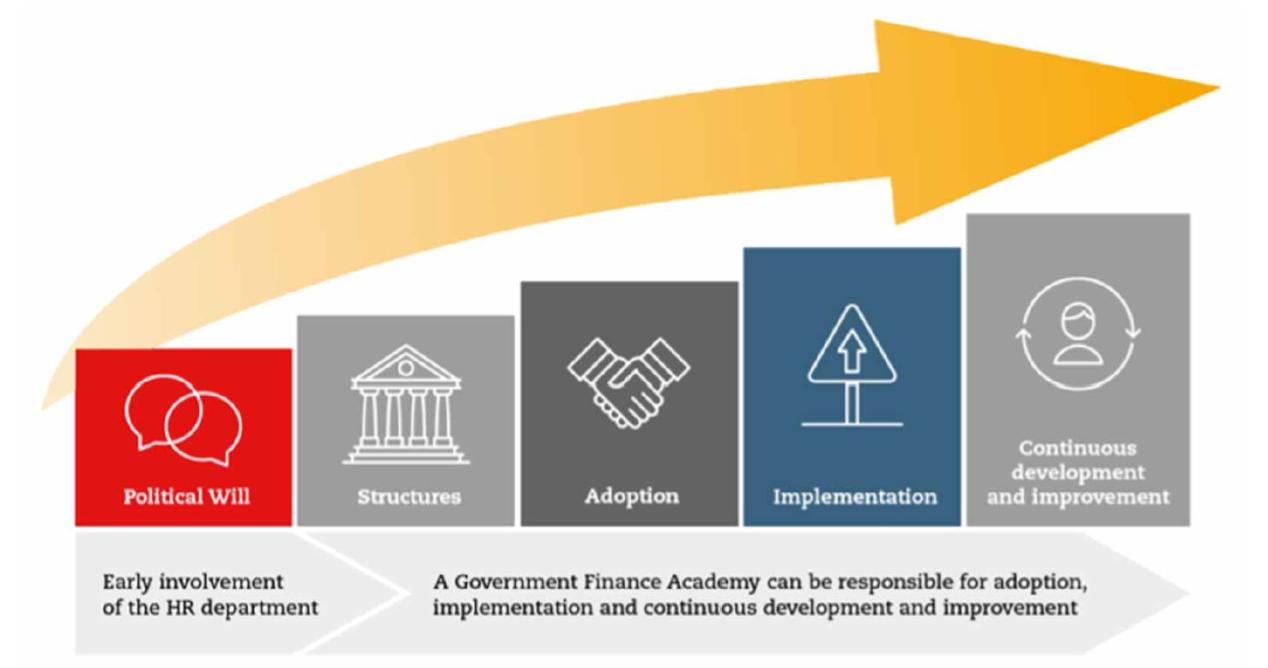

The report examines the routes for making and sustaining PFM reforms, and argues that political leadership and commitment to professionalisation is the most important factor until changes are embedded in the system.

‘In some countries,’ it states, ‘there is a lack of recognition that change is needed at all’, while in others, PFM reforms have concentrated on the move from cash-based to accrual-based accounting without significant effort to professionalise staff or provide opportunities for training.

The report uses cases studies from around the world to show how some governments have approached their journey to professionalisation.

In terms of creating the right structure and building strong finance functions, the report uses the example of the UK, which established the Government Finance Profession (later renamed the Government Finance Function) after a financial management review in 2014.

The Government Finance Academy, created in 2016, provides the training and development to help improve financial skills, capability and talent across the Government Finance Function.

It is also important to identify the current and future needs of the finance function. In Cyprus, the government undertook a skills gap analysis of its finance function in 2014 as part of its response to the economic crisis in the country. This assessed key staff attributes, including core leadership skills, organisational skills, technical skills, and cultural and behavioural standards.

In terms of implementation of a professionalisation programme, the report looks again at the experiences of the Cypriot Treasury. Suitably qualified leaders who drive reforms from the top down, says the report, are essential to successfully managing PFM reforms.

'The presence of qualified finance professionals helped to bring back trust and confidence in financial figures.'

The Cypriot Treasury increased the number of qualified accountants at middle and senior level, often recruited from the private sector, to introduce a deeper level of knowledge and experience to support reform. It also ensured that each ministry had a finance team that was led by one or two professional accountants, with clear reporting lines.

Overall, the number of qualified accountants in the Treasury increased from 7% of all staff in 2005 to 33% in 2022, and the presence of qualified finance professionals at all levels helped to bring back trust and confidence in financial figures.

When it comes to training to support a professionalisation programme, the report looks at the experiences of Malaysia’s Auditor General’s Office. Its professionalisation programme has steadily increased the number of qualified accountants in the office over the past decade, which has resulted in an improvement in the quality of audit work.

Finally, the report looks in detail at the experience of the UK national health service in Wales – or NHS Wales – when it comes to CPD.

‘The journey to professionalisation does not end when there is a commitment and a programme to recruit and/or train finance professionals,’ says the report. ‘The skills and qualities that may be required at the start of the journey will change over time.’

The Wales NHS Finance Academy has taken clear steps to learn from others through a series of internal cross-government networks (such as the Finance Director Forum), and external networks that help its finance professionals better understand alternative approaches to finance, ways of creating insights and other issues.

Hear from experts working in the public sector at ACCA’s 12th International Public Sector Conference, now available on demand.