Much has been made of the transformational possibilities of digitisation for accountancy practices, but what are the opportunities for smaller accountancy practices (SMPs) and just how far along their digital journeys are they? A survey completed in early 2022 examined how and why SMPs are going digital—and the barriers and benefits to doing so.

The Key Findings

- SMPs have embraced their online presence and are using social media. However, many still have some way to go on the digital journey.

- The bigger the practice the more digitally advanced they are.

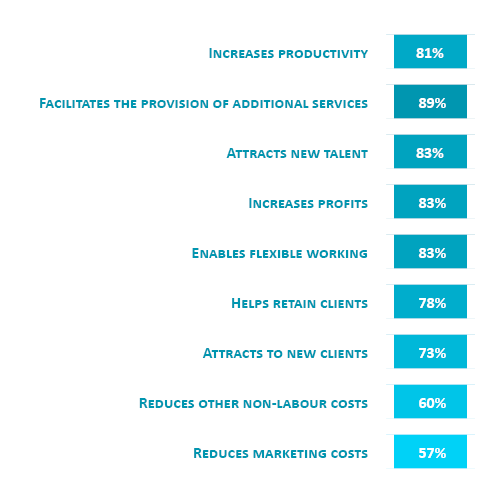

- A number of challenges were identified, the greatest of which was client buy-in. Clients were reported as being unable or unwilling to do things differently.

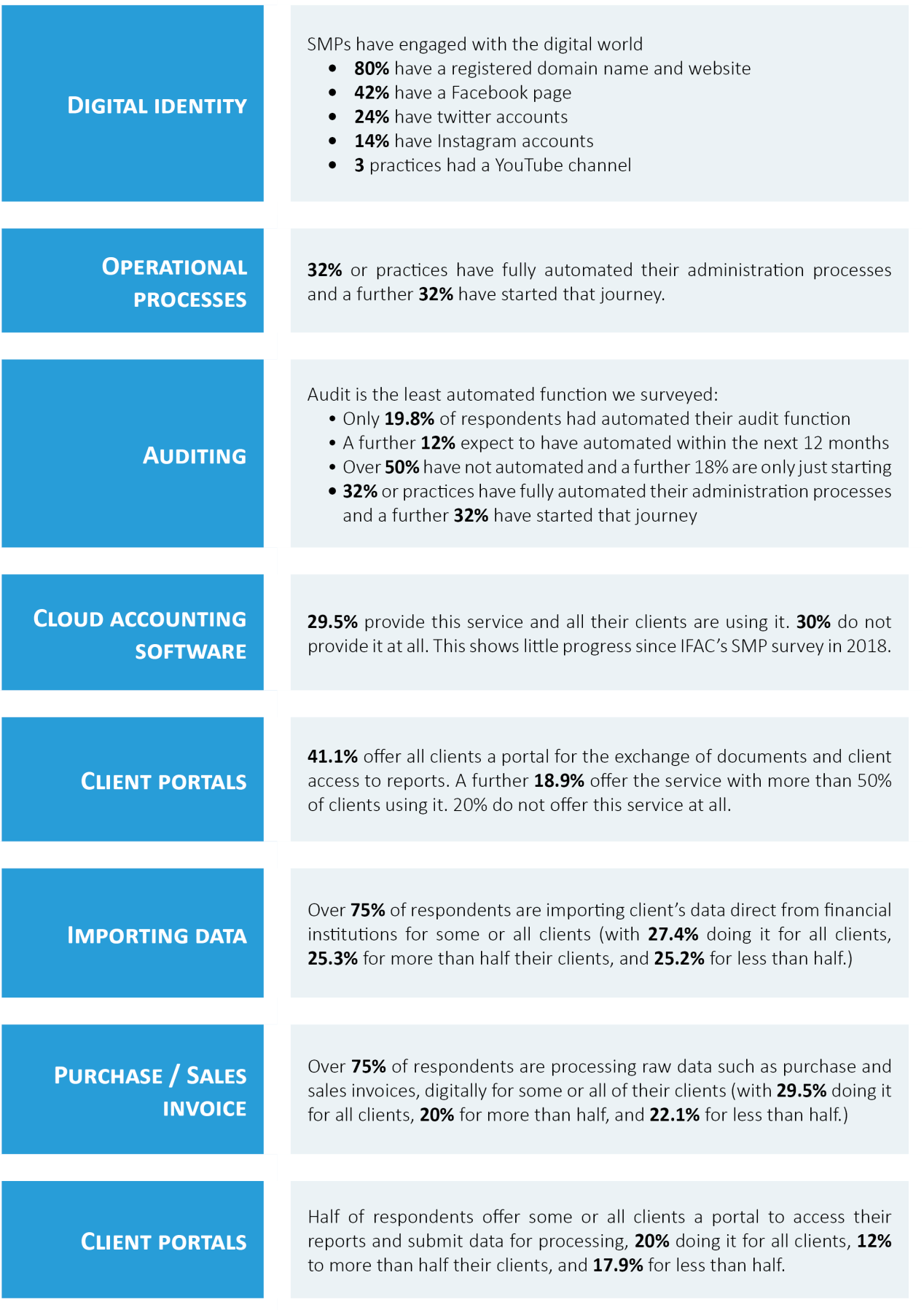

- However, the more digitally enabled practices reported significant benefits in productivity, flexibility and overall attractiveness of the practice to new recruits, and to existing and potential clients.

The Survey

The survey was completed by Gail McEvoy, Managing Partner of McEvoy Craig, Past President of CPA Ireland, IFAC Board Member 2013-2019 and Technical Adviser for the IFAC Small and Medium Practices Committee.

The survey was qualitative, and respondents were evenly split between the UK and Ireland. Respondents were all small and medium sized practices (SMPs) where:

- 85% had turnover of less than €1m

- 57% were sole practitioners

The Results

Image

Much has been made of the transformational possibilities of digitisation for accountancy practices, but what are the opportunities for smaller accountancy practices (SMPs) and just how far along their digital journeys are they? A survey completed in early 2022 examined how and why SMPs are going digital—and the barriers and benefits to doing so.

The Key Findings

- SMPs have embraced their online presence and are using social media. However, many still have some way to go on the digital journey.

- The bigger the practice the more digitally advanced they are.

- A number of challenges were identified, the greatest of which was client buy-in. Clients were reported as being unable or unwilling to do things differently.

- However, the more digitally enabled practices reported significant benefits in productivity, flexibility and overall attractiveness of the practice to new recruits, and to existing and potential clients.

The Survey

The survey was completed by Gail McEvoy, Managing Partner of McEvoy Craig, Past President of CPA Ireland, IFAC Board Member 2013-2019 and Technical Adviser for the IFAC Small and Medium Practices Committee.

The survey was qualitative, and respondents were evenly split between the UK and Ireland. Respondents were all small and medium sized practices (SMPs) where:

- 85% had turnover of less than €1m

- 57% were sole practitioners

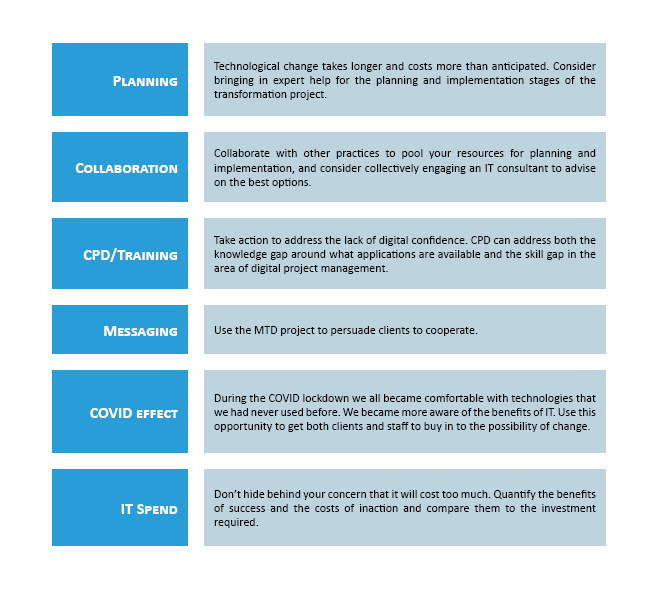

The Results

Image

Challenges of Digitisation for SMPs

We identified 7 key challenges that the majority of respondents agreed with or strongly agreed with:

Image

Summary

There is still some way to go for SMPs in respect of implementing technology. The SMPs who participated in this survey had not made significant technological advances to those identified in the survey carried out by IFAC in 2018.

Some are resistant to change. The lack of progress in the deployment of readily available cloud-based accounting software is typically blamed on client resistance. Smaller clients often prefer the old school approach of “handing it all over in shoebox”. Others attempt to use the cloud-based system, but make mistakes, which are time consuming for the accountant to correct. Clients who had previously thought their accountant was a magician, move towards believing they have done half the work themselves.

The vast array of software available makes it hard for smaller practices to identify the best options for their practice, and there is a perception that applications do not “talk to each other”, leading to duplication and inefficiency. A digital champion may be required to get over this, but smaller teams do not have space for a specialist.

In the UK, the Making Tax Digital (MTD) initiative has caused concern among participants as it reduces the need for the accountant’s input. Smaller accounting practices need to move at a faster pace than the last three years to be ready for this. Lack of buy-in from clients could perhaps be partly overcome by using the MTD initiative as evidence of the need to change.

Larger practices, with fee income over €1m, had made more significant progress than smaller ones, where there is clearly a need for better guidance and assistance in making the journey.

The benefits of digital transformation seem less apparent to smaller practices, where the pain of manual transactions is lower. The potential costs, by contrast, are clear and this deters smaller practices from making the journey.

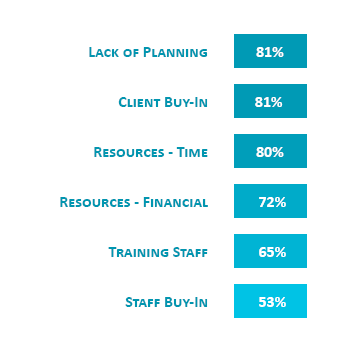

Key Recommendations

It is clear that smaller practices risk being left behind in the process of digital transformation. So here are Gail McEvoy’s top recommendations to help SMPs achieve the benefits of digitisation while mitigating the challenges:

Image