The accountancy profession is first and foremost a profession made of people—individuals and teams working collaboratively and collectively. Events like the COVID-19 pandemic help us reflect on what really matters—the human element of the profession and the work that it does. Every year, millions of professional accountants worldwide create billions of dollars of value for a wide spectrum of stakeholders while acting in the public interest. They do this by acting ethically and with integrity while applying their professional judgment, technical skills, high level of education, and training to support business resilience and success. [1] Understanding the connection between people, education, professional judgment, ethics, value and the public interest, is central to the ongoing relevance of the profession.

Digital transformation and technology will continue to change the day-to-day work of professional accountants regardless of their role or location.[2] However, the reallocation of tasks from manual processes to technologically-assisted solutions will only increase the value and importance of trust and professional judgment—the cornerstones of the accountancy profession.[3] Only people can engender trust and apply professional judgment. The profession must seize this transition as an opportunity by focusing on the basics of ethics and integrity, while developing the digital skills—as well as the human and other skills—required to ensure the ongoing relevance of the profession.

As the technological environment changes rapidly, so too does the societal environment. The spirit of society’s evolving priorities and expectations is captured by the United Nations’ Sustainable Development Goals (SDGs). Businesses and Governments both have a role to play and must rise to the occasion.[4] The accountancy profession intersects with the SDGs in a number of ways, and it is incumbent on everyone working within the professional accountancy ecosystem to align themselves with these goals.[5]

Firms, Professional Accountancy Organizations (PAOs), standard setting boards, businesses, regulators and professional accountants themselves must embrace the notion that the continued relevance of the accountancy profession fundamentally depends on people. It is about continuing to maximize the value that professional accountants contribute to a broad range of stakeholders, in the public interest, and creating an environment where talented people are attracted to careers in a dynamic profession that contributes to sustainable businesses and societies.[6] All participants in the accountancy ecosystem, most notably PAOs and their members, must act proactively rather than reactively in the face of a dynamic future.[7]

Translation Available in

1. A profession made of individuals

Beyond simply ‘human capital,’ professional accountants are individuals, each with their own unique competencies, experiences and aspirations. Firms, organizations and PAOs that approach members, staff and clients from this perspective will be better able to attract, challenge, and retain talented people throughout their careers. Moreover, appreciating the individual characteristics of professional accountants helps foster an environment where trust and judgment can thrive. At the same time, professional accountants must embrace their role in ensuring an ethical, future-relevant profession.

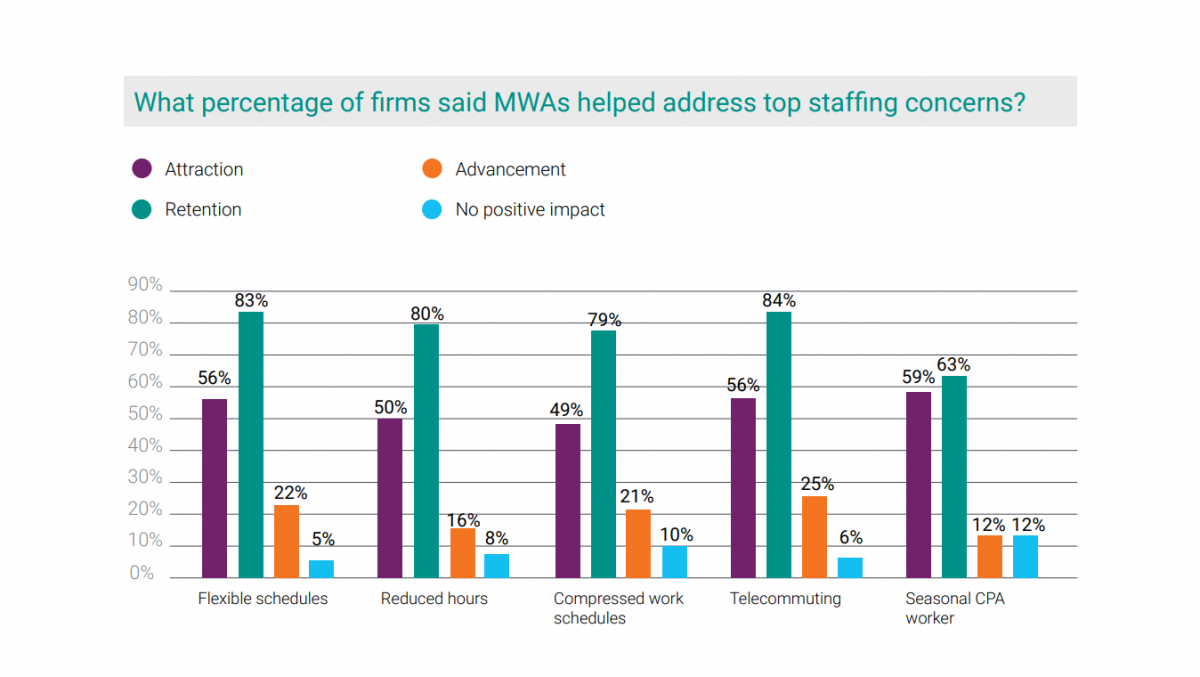

- Under normal circumstances, professional accountancy work is challenging, often with tight timelines, long hours and increasing expectations from stakeholders and regulators. During times of stress—be it a pandemic, natural disaster, or other systemic/societal disruption—these challenges increase. Acknowledging this, we encourage employers, PAOs, and accountants to foster meaningful work-life balance.[8] Conditions that enable work-life balance—supporting professional and personal satisfaction—make high performance sustainable at the individual level. If there is a silver lining to the COVID pandemic, it has demonstrated how technology enables greater flexibility. Accommodating flexible work arrangements makes the profession accessible and attractive to a broader array of individuals, facilitating greater diversity and inclusiveness.[9]

- Mental health is as important to well-being and productivity as physical health, yet the stigma associated with acknowledging mental health issues can prevent many from getting needed help. Employers and PAOs must take a holistic and non-discriminatory approach to health.[10]

- We encourage firms and PAOs to consider how they can support their staff and members. This might involve:

- promoting the importance of, and facilitating access to, mental health and overall wellness and self-care;

- reinforcing a diverse and inclusive environment that supports mental health;

- establishing networks that help build relationships and the exchange of experiences among peers;[11] and

- establishing, communicating and reiterating confidential processes to help individual accountants and/or staff deal with ethical issues that they may be facing in their work.

IFAC, in turn, looks to be a resource for PAOs in developing these initiatives by leveraging our global network and role as a convener.

- Beyond the professional value that accountants provide, we encourage them—as people and members of society—to play an active leadership role in their communities by leveraging their education, skills, business acumen and integrity. Where possible, professional accountants should consider making volunteering and/or pro bono work a meaningful part of their professional life, especially during times of adversity. We encourage PAOs and firms to accommodate and facilitate such activities amongst staff/members.[12]

- IFAC believes that a diverse and inclusive culture, where professional accountants can bring their authentic selves to work, combined with meaningful work-life balance and appropriate mental health awareness, all contribute to a culture of trust and integrity. For the global accountancy profession, a culture of trust and integrity supports its ability to deliver on its public interest mandate, thereby increasing its relevance into the future.

Modified work arrangements have great value

2019 CPA Firm Gender Survey - AICPA

1. Nexus 2: The Accountancy Profession – A Global Value Add, IFAC, November 12, 2015.

2. IFAC’s Practice Transformation Action Plan discusses how practices and professional accountants can best evolve with technology, move from transactional to strategic services, and continue to enhance their relevance into the future.

3. See Prediction Machines: The Simple Economics of Artificial Intelligence, Agrawal, Gans, & Goldfarb, 2018. Artificial intelligence does not bring us intelligence but instead a critical component of intelligence—prediction. Advances in “artificial intelligence” applications dramatically reduce the cost of prediction so as to materially increase the value of complements to prediction, including judgment.

6. For example, FinBiz2030, a joint initiative between Chartered Accountants Worldwide and One Young World, aims to establish an active and engaged business community globally that is dedicated to achieving the SDGs by 2030.

7. See Audit in Action from the CAQ for a series of stories highlighting how auditors are innovating to continue to deliver value to the capital markets.

8. See, for example, Keeping the Audit Profession Attractive.

9. 2019 CPA Firm Gender Survey, AICPA, March 2020. For more on flexible working arrangements, see When it Comes to Talent Retention, Think Flexibly.

11. This is of particular importance for people entering the profession, who significantly benefit from young professional networks and mentoring programs, and cite access to a network as a key motivation for joining a PAO. See Accountancy Europe’s The Future of Professional Organisations.

12. Accountancy Europe provides inspiring stories of accountants making a difference in its Stories from Practice. IFAC, for its part, has developed the IFAC Cares volunteering program where IFAC can spend time volunteering for the local community in New York City. See https://twitter.com/IFAC/status/1156999602320658432

2. Education drives a dynamic profession

The education that leads to an individual qualifying as a professional accountant is just the beginning. More than ever, the profession offers a broad range of opportunities, with career paths becoming career lattices. People qualifying as professional accountants today may be practicing into the 2060s and beyond! Their relevance and the timeliness of their skills, as well as the satisfaction they derive from professional life, depends on lifelong learning—all the more so in a rapidly changing environment. Individuals must be prepared to reskill in order to remain relevant in the future.

- Professional accountants must take personal responsibility for their own lifelong learning and career development elevating learning from a passive, compliance-based approach to one in which learning is tailored, reflective and actively driven by individual needs.[13] Professional accountants should see PAOs as their key partner in lifelong learning. By driving their own education pathway, professional accountants can take charge of developing sustainable careers. PAOs must likewise be responsive partners in enabling their members’ career journeys.

- IFAC believes that ethics and continuing professional development are integrally linked, and that one of the key differentiating factors of a career as a professional accountant is the ethical core established by the International Code of Ethics for Professional Accountants (including International Independence Standards). Ethics is the foundation of a purpose-driven profession, defined by its most valuable asset—trust.[14] IFAC urges professional accountants to enthusiastically embrace their ethical obligations as a core part of their lifelong education. Professional accountants also have an ethical responsibility to be competent for any work they undertake.[15] As stakeholder demands and technology evolve, remaining relevant increasingly requires ongoing upskilling and reskilling—professional accountants should not just expect to do the same things differently, but also do different things.

- IFAC strongly encourages PAOs and others involved in learning and development to adopt and implement the International Education Standards (IESs) when setting education requirements for current and aspiring professional accountants. The IESs establish requirements for entry to professional accounting education programs, for initial professional development, and for continuing professional development. In so doing, the IESs help establish the foundation for trust in the profession at a global level.

- IFAC’s approach to advancing accountancy education has been developed to engage a wide range of stakeholders to facilitate agile responses in a rapidly changing environment. IFAC supports the International Panel on Accountancy Education (IPAE) and its call to action urging PAOs, organizations, and individuals to take steps to re-imagine the future accountant.[16] The IPAE is a key component of IFAC’s accountancy education stakeholder engagement framework; it provides strategic advice and advocates for quality education for future-ready accountants. Further, IFAC leverages its role as convener with our international education summit and the Knowledge Gateway as a central location to access thought leadership, guidance and other resources.

- In addition to technical competencies, such as business acumen, digital acumen, and data interrogation, synthesis, and analysis, professional accountants must develop behavioral competencies, such as intellectual curiosity, critical thinking, and adaptability in order to effectively respond to an environment of rapid change and embrace new or alternative ways of working. Emotional intelligence and strong communication skills will strengthen a professional accountant’s ability to engender trust in clients or other stakeholders and “tell the story behind the numbers.” Lifelong learning must focus on these, as well as refreshing technical skills. In so doing, professional accountants can maximize the value they add as trusted business partners.

- Sustainability and other non-financial information will play an increasing role in corporate reporting because this information improves the relevance of communication between companies and their stakeholders. It also increases the relevance of the assurance and non-audit services that the profession provides. This is an emerging and evolving field that will rely on the core skills of accountancy but require a significant investment in learning and development. IFAC encourages PAOs, firms, academics and businesses to continue to work together so that the profession enhances its skills and delivers new relevance to corporate reporting and assurance in the public interest.

14. Accountancy Europe’s surveys of young professionals show the importance of values in their career decisions. See also, The 21st Century Profession from CAANZ.

15. R113. Professional Competence and Due Care, The International Code of Ethics for Professional Accountants (Including International Independence Standards).

16. Progressing IFAC’s New Approach to Advancing Accountancy Education, August 7, 2020.

3. Diversity, equality and inclusion enhance the profession

Significant progress towards embracing diversity (of people and skills) and ensuring equality with respect to demographic and identity features such as age, race, religion, gender, sexual orientation, disability, socio-economic background and national origin has occurred around the world. However, there is still more to do, both within society and within the profession. Gender equality stands out as an area of continued global focus, as recognized by the SDGs. The accountancy profession can and must take the lead on achieving gender equality and fully embedding a culture of diversity and inclusion into its DNA. It’s the right thing to do; it’s good for business; and the continued relevance of the profession depends on it.

- IFAC supports the call of SDG 5 to achieve gender equality and empower women and girls so that they may effectively participate in and have equal opportunity for leadership at all levels of decision-making in political, economic and public life. IFAC calls on the global accountancy profession to make gender equality the reality—a given, not a goal. Importantly, there is no gender equality without compensation equality.[17]

- Harassment, bullying and intimidation have no place the profession. A truly diverse and inclusive working environment is impossible with these negative cultural attributes. Achieving and maintaining a supportive, healthy, professional working environment, is an ongoing task and must be a priority.

- IFAC believes that workforce diversity—in demographics, race, backgrounds and experiences—facilitates diversity of perspectives. Diversity of perspectives leads to better decision-making, be it within management or the governing body of a business or organization, within a professional services firm or individual engagement team, within the membership or staff of a PAO, or throughout the profession as a whole.[18] Ensuring the highest possible quality of decision-making is critical for the accountancy profession, where the central value proposition is trust and judgment. As such, diversity of perspectives is a strategic imperative.

- Diversity of skills within firms, businesses, the public sector and PAOs is increasingly necessary as the demands of society and stakeholders evolve, business grows more complex, and technology plays a more central role. All areas of the profession benefit from skill diversity, and individuals who successfully integrate traditional accountancy skills with other/complimentary skills will be in high demand.[19]

- IFAC believes the multidisciplinary firm business model—which allows for specialists (e.g., risk advisory, forensic reviews, information technology, tax, etc.) to operate within one firm—creates an environment where diverse skill sets gather and develop. Initiatives to limit multidisciplinary firms would reduce skill diversity, negatively impacting the profession’s ability to best serve its clients, and contribute to the public interest.[20]

- Diversity of perspectives is not achieved by meeting a metric at a certain point in time. Diversity without meaningful inclusion in decision-making and leadership has no impact. Certain metrics can provide useful information for stakeholders, for example with respect to the composition of Boards.[21] IFAC and IPSASB, for example, have both recently achieved equal gender representation on their boards.[22] However, IFAC believes that diversity and inclusion as a mindset that should be embedded into work cultures at every level. Consideration of diversity must be at the heart of a people-centered profession.

17. See Embedding a culture of equality, diversity and inclusion from ICAS for a more in-depth analysis of the benefits to the profession.

18. See Toward Gender Equality: Accounting for Change, IFAC, March 5, 2020. See also Balancing Gender to Enhance Organizational Performance Webinar, IFAC, March 5, 2020. See also Enhancing Board and Committee Governance with a Gender Balance, IFAC, March 4, 2020.

19. See Delivering through Diversity, McKinsey & Company, January 2018. See also, re: gender and demographic diversity, Research: When Gender Diversity Makes Firms More Productive, Harvard Business Review, February 11, 2019. See also, re: diversity of skill sets, Getting Specific about Demographic Diversity Variable and Team Performance Relationships: A Meta-Analysis, Bell et. al., Journal of Management 37, no. 3, 2011.

20. See, for example, The Future of Talent: Opportunities Unlimited from CAANZ.

21. See Audit quality in a multidisciplinary firm What the evidence shows, IFAC, ACCA & CAANZ, September 25, 2019.

22. See, for example, Ethnic Diversity Enriching Business Leadership: An update report from The Parker Review, February 5, 2020.