The public sector is an essential part of every economy[1]. Governments spend large sums of public money on a range of services and infrastructure for their citizens. And in times of crisis, such as the 2008 global financial crisis, and more recently the COVID-19 global pandemic, governments increasingly use fiscal policy measures to support public social, infrastructure and health systems, and provide direct financial support to businesses and citizens through measures such as income support and unemployment benefits. Only governments are able to provide this kind of support at scale during these crises.

Globally, public sector entities face many challenges, which can include increased demand for high quality services, outdated infrastructure, tax competition[2], a low tax base, loss of trust[3], and the impact of changing demographics causing funding shortfalls for pension and social benefit schemes.[4]

As governments contend with competing priorities, they need to make important decisions with the aim that short-term measures are taken with appropriate regard to long-term financial sustainability and resilience. Decisions made by governments today will impact generations to come[5], and will have implications for future policy, tax, and spending decisions. The basic social contract between governments and citizens is continually changing, and therefore, there is heightened need for transparency and accountability to help citizens understand how public funds are being managed and spent[6], how decisions are made and why, and the evidence and information to support decisions.

To ensure governments and public sector entities around the world make informed decisions for people, the planet, and the economy, they need strong governance and public financial management (PFM). The accountancy profession—professional accountancy organizations (PAOs) and individuals—have an important role to play in supporting fit-for-purpose PFM and an effective public sector. Working together, the public sector and accountancy profession can help deliver a more sustainable, inclusive, and prosperous future.

Translation Available in

1. Strong governance and public financial management

To manage public resources effectively and efficiently, governments need strong governance and a robust PFM system so that the use of resources is tracked, and that resources are appropriately allocated against public policy objectives. Governments must endeavor to achieve the most with the resources they have, maximizing efficiencies in public service delivery, while minimizing loss through waste, fraud, or corruption. Governments face numerous competing priorities and require reliable financial and non-financial information to make informed, data-driven decisions on priority areas of spending and investment. To enhance governments’ accountability for decision making high levels of transparency are required

- Good governance in the public sector is fundamental to ensure that public sector entities achieve their intended outcomes while acting in the public interest at all times[7].

- Global variations need to be addressed as the strength of governance frameworks and PFM systems and processes varies widely, and improvements are needed in most jurisdictions[8]. Embedding a foundation of financial discipline and internal control across public sector entities remains a key priority for most jurisdictions. IFAC believes that achieving PFM reform is fundamentally dependent on:

- Commitment from political leaders and senior management within public sector entities, supported by a change management plan.

- People—with training and skills in government and public sector entities—from entry-level to senior leadership roles. The accountancy profession with its strong ethical core has a significant role to play in supporting professionalism in public finance and promoting ethical behavior in public sector entities. (See section: The accountancy profession in the public sector).

- A comprehensive, robust, principles-based PFM framework[9] underpinned by an integrated financial management information system. An incremental approach[10] to PFM reform may be required to best consider the local context, set achievable targets, and make increasing improvements as capacity is strengthened.

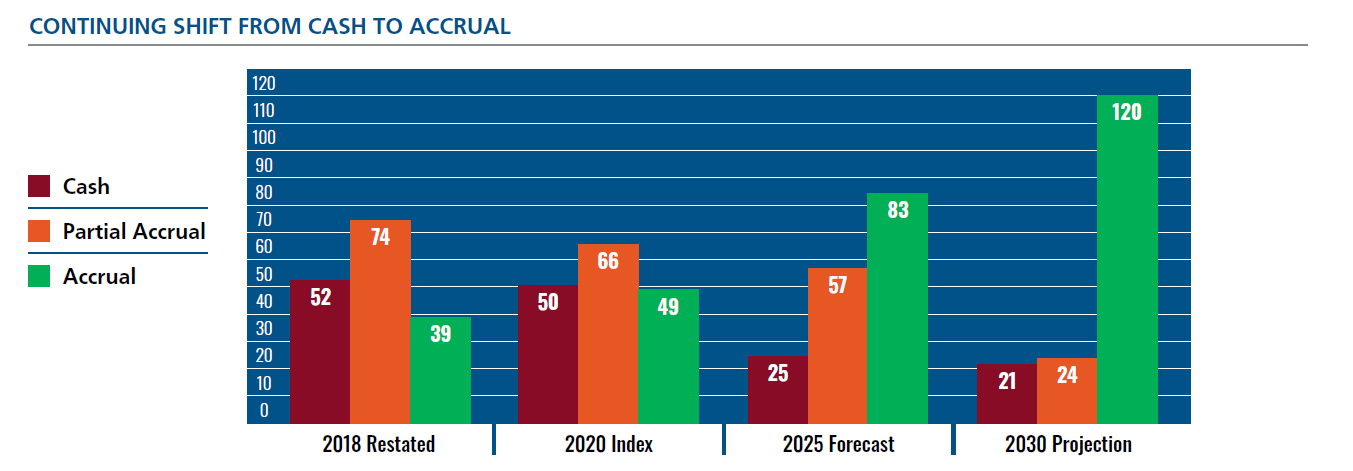

- High-quality, global public sector accounting standards are critical to strong PFM playing a significant role in supporting public sector transparency and comparability, accountability and decision making. IFAC strongly advocates for the adoption and implementation[11] of accrual accounting, in particular the accrual-basis International Public Sector Accounting Standards (IPSAS)[12].

- Accrual accounting requires strong internal controls, processes and record keeping, and ensures public sector assets and liabilities are appropriately recognized and valued, and improves the capability for their management. For assets, this includes better maintenance, more appropriate replacement policies, identification and disposal of surplus assets, and better understanding of the impact of using fixed assets in the delivery of services. Reliable recording of all liabilities helps ensure appropriate repayment and extension management, such that governments are able to meet liabilities as they fall due and understand the extent to which they can afford new programs and services.

- Implementing accrual accounting should be part of a broader PFM reform program rather than the end goal: as a means of supporting a range of other objectives, such as improving government transparency and performance, minimizing opportunities for fraud and corruption[13], and more effectively managing public sector assets and liabilities[14]. IFAC believes that to maximize the benefits of a move to accrual accounting, the same accrual-based information should be used for as many purposes as possible, including for macroeconomic management and budgetary control[15].

- Public sector spending can be susceptible to waste, fraud, and corruption[16]. IFAC believes that minimizing this risk requires senior management to embed robust systems, a strong internal control environment, and high-quality reporting, all supported by Supreme Audit Institutions (SAIs)[17] with the capacity, resources, and independence to help strengthen public sector entities—by confirming that controls are operating effectively, identifying waste, and suggesting ways in which government can better operate. To be effective, SAIs must be appropriately funded and staffed, with the independence to effectively fulfill their mandates, delivering both financial audits (in accordance with International Standards on Auditing), and performance and compliance assurance engagements, which is essential to building trust in the information that public sector entities provide to stakeholders. The audit profession in the private sector can support SAIs in developing capacity, helping build up the skills, knowledge, and experience of public sector auditors[18].

1. This document will use the IPSASB definition of public sector: Public sector entities include national, regional (for example, state, provincial, territorial) and local governments (for example, city, town) and their component entities (for example, departments, agencies, boards and commissions). It is not meant to refer to State-owned Enterprises (SoEs) or similar commercial entities.

2. Referring to countries using preferential tax rates as a competitive advantage, both “acceptable” tax competition and “harmful” tax competition

3. Edelman Trust Barometer 2021: Government was the most trusted institution in May 2020, then lost its lead 6 months later and is now less trusted than business and NGOs.

5. ICAEW/PwC: Intergenerational fairness “Today’s intergenerational policy challenge ranges from employment to social affairs and healthcare, from education and infrastructure to pensions. It encompasses financial as well as non-financial liabilities, e.g., in form of ‘environmental debt’ that we leave behind for future generations.”

6. An example approach - the Open Government Partnership (OGP) promotes and supports the importance of government transparency for citizens by ensuring that civil society organizations or direct citizen engagement has a role in shaping and overseeing governments.

9. Examples include CIPFA’s Whole Systems Approach, PEFA’s PFM Framework, and CAPA’s Eight Key Elements of PFM Success.

10. Public Finance Focus: Challenges to successful PFM reform

11. Successful implementation of these standards is a complex, resource-intense, multi-stakeholder endeavor requiring expertise and adequate infrastructure. To support best practices in Africa, PAFA has issued guidance on practical approaches: International Public Sector Accounting Standards (IPSAS) Implementation Road Map for Africa

12. Although there has been positive momentum behind the global transition to accrual accounting, full implementation of IPSAS is still a longer-term endeavor for many governments. For those, we encourage the use of the COVID-19 Intervention Assessment Tool, as an immediate way of evaluating the financial impacts of current and planned policy initiatives. This tool can be used independently of where a jurisdiction is on the path to full accrual.

13. The B20 Integrity & Compliance Taskforce, for example, recently recognized this in its 2020 recommendations to the G20: The B20 also recognizes that there is a link between public procurement, public sector accounting and corruption, and that implementation of high-quality accrual accounting standards in the public sector leads to lower incidences of corruption. The B20, therefore, further calls on the G20 Members to lead the way in the global application of accrual accounting in the public sector and, in particular, the International Public Sector Accounting Standards.

15. IFAC/ACCA: Is Cash Still King? Subject matter experts interviewed for this research argued that there were advantages for governments in consistently applying an accrual basis through the entire PFM system. They strongly supported this approach for producing rich, decision-useful information for governments.

16. The consequences of corruption are significant and widespread, from direct costs to individuals and society, to encouraging criminal behavior and undermining trust in institutions. Grounded in a strong ethical code, professional accountants across the globe play a critical role in the fight against corruption: Fighting Corruption and Money Laundering | IFAC. See also IFAC/ICAEW series: Anti-Money Laundering: The Basics

17. The International Organization of Supreme Audit Institutions (INTOSAI) has developed a comprehensive set of professional pronouncements for SAIs along with a number of guides, tools and models that support the development of SAIs.

18. In developing the institutional capacity of SAIs (and, as a result, the capacity of individuals), a staff exchange program between SAIs, as well as between SAIs and private sector audit firms involved in public sector auditing, can be helpful as a means of building up skills of the SAI’s staff in respect of auditing accrual-based financial statements, and to provide a knowledge exchange between different auditors. Alternatively, subcontracting all or part of public sector audits to private sector audit firms can help to bring specialist skills to audits where those skills are not present in the public sector audit body. It can also ensure that public sector audit bodies maintain their audit methodologies in line with best practice in the private sector.

2. The key role of the accountancy profession in the public sector

While frameworks and standards are crucial to strengthening PFM, having the right people, with suitable training and the right skills and competencies across governments and public sector entities, is fundamental. However, in many jurisdictions, there is a shortage of professional accountants in the public sector. Public sector leaders must understand and embrace the importance of the skills, ethics and public interest focus that the accountancy profession can bring. In serving the public interest, there is an incredibly important need for public sector leaders and the accountancy profession to work together in supporting professionalism in the public sector. Together, we can create a better world with stronger economies and fairer societies.

- Helping make the right decisions: We believe the diversity[19] and skills of public sector finance professionals, in their various roles at governance, strategic, and operational levels, are integral to inclusive, transparent decision-making within public sector entities; providing direction and clarity through decision-useful insights and information to support short, medium, and long-term financial planning; implementing spending control and assurance frameworks (including effective public procurement systems and internal controls); and supporting scenario planning and enhanced data analytics for better policy making. The professionalization[20] and continuous professional development requirements for professional accountants working in public finance will lead to better and more transparent decision making.

- Acting in the public interest: Professional accountants have a responsibility to act in the public interest and are therefore uniquely positioned to strategically advise and support governments and public sector entities. This requires the facilitation role of accountants with other professionals and engagement with civil society, the public and the parliamentarians. IFAC believes there is an important role for professional accountants— with their ethical code, technical expertise, and other skills such as leading/influencing, and communication[21]—to play central roles within governments and public sector entities, helping them to make tough choices, innovate, enhance efficiency, and reinforce trust in public sector decision making, services and spending. They can also play an important role as guardians against corruption, illicit financial flows, and exploitation of resources. Professionalization of those working in the public sector – especially those in accounting and finance roles – would also assist in addressing some of the challenges experienced by SAIs[22] and others such as councils and audit committees, in their oversight roles.

- Leveraging PAO support: PAOs can contribute to and support the implementation of robust accounting practices in the public sector-creating closer linkages and connections between PAOs, professional accountants and governments, ultimately to improve government decision-making, professionalism, and accountability. PAOs also have an important role in ensuring their members embrace continuous professional development and high ethical standards (e.g., by providing support for their members in dealing with ethical dilemmas) and in holding them accountable for their actions through effective investigation and discipline of misconduct and breaches of professional standards.

- Drawing on the expertise of the global profession: Where an established PAO does not exist or lacks sufficient capacity, IFAC encourages collaboration across the global, regional, and national levels of the accountancy profession, as well as the direct involvement of the international development community[23]. IFAC believes that PAOs from all regions and development levels can learn from the examples of others. Approaches include:

- The African Professionalisation Initiative

- Providing specific PFM certifications

- Using an accounting technician qualification as a pathway into the accountancy profession[24]

- PAO models for incorporating public sector accountants, such as a public sector specific PAO, a public sector department within a PAO, and incorporating public sector topics/coverage into existing qualifications[25]

- Establishing within PAO governance structures, committees that provide advice on public policy and accountability matters within their jurisdictions[26]

19. IFAC Point of View: Embracing a People-Centered Profession - Diversity of skills within firms, businesses, the public sector and PAOs is increasingly necessary as the demands of society and stakeholders evolve

20. Professionalization involves increasing the number and capacity of skilled and competent professionals, with suitable training and recognized qualifications, and ensuring strong professional and ethical standards.

21. CIPFA: Competencies are needed around areas such as public sector context and needs; technical skills; leading and influencing; and increasing public value

22. The INTOSAI Capacity Building Committee (CBC) recognizes that SAIs operating in complex and challenging contexts may have greater challenges than other SAIs in availing themselves of the tools, models and support available within the INTOSAI community or implementing existing standards and guidance.

24. IFAC/AAT An Illustrative Competency Framework for Accounting Technicians -The Framework’s illustrative example is a resource for PAOs creating an Accounting Technician designation as an additional pathway into the accountancy profession.

25. Example approaches are set out in CAPA’s publication, PAOs: Extending Activities into the Public Sector

26. The Public Policy and Governance Committee at ICPAK is such a committee. PAFA aims to assist its other PAOs members establish similar committees.

3. Preparing for 2030

The United Nation’s Sustainable Development Goals (SDGs), in combination with national sustainable development plans, provide context to government policy and spending decisions to address systemic, interconnected issues such as climate, inequality, access to education, and poverty. But to date, efforts to achieve the SDGs have fallen short[27] and widening inequality between and within countries remains a huge challenge[28]. Governments have a significant contribution to make in delivering the SDGs, not only in their policy and operational roles, but through collaboration globally ensuring no country is left behind, and nationally with different sectors and stakeholders[29], including public-private sector partnerships.

- Determining the interventions necessary to optimize achievement of the intended outcomes: Making the decisions necessary to balance the many post-pandemic priorities with delivery of the SDGs requires relevant, reliable and comparable financial and non-financial information. In the public sector it is important to understand the impact of spending on social value and outcomes. Therefore, IFAC supports performance reporting that integrates financial and non-financial information to provide a more comprehensive picture, and accountability over outcomes and performance, which is so important in the public sector given the connectivity of policies[31]. Examples include:

- The International Integrated Reporting Framework

- The UK’s Public Value Framework

- New Zealand’s well-being approach to budgeting

- IPSASB guidance on the relevance of IPSAS and related Recommended Practice Guidelines (RPG) for reporting on climate change and the SDGs in the general-purpose financial reports of public sector entities.

- Managing risks and performance: IFAC believes that strong PFM is an essential foundation to achieving the SDGs, given that huge additional investment by governments will be required. Better management of public sector assets and liabilities is critical to raising financing to support SDG investments[32]. Governments must also understand the long-term financial impacts (including on future cashflow—inflows and outflows) of any policies to address the SDGs, as well as risks arising from climate and social related issues. To provide transparency on public sector entities’ financial resilience, IFAC encourages use of IPSASB’s Recommended Practice Guideline (RPG) 1, Reporting on the Long-Term Sustainability of an Entity’s Finances.

- Broader performance reporting: IFAC believes that the public sector must increase its focus on reporting high-quality, relevant, reliable, and comparable non-financial information. Market-driven, or voluntary, reporting is how the process starts, but policy intervention will eventually be needed to deliver relevant, consistent, comparable, and verifiable information to stakeholders. A proportionate approach is important, recognizing that in many jurisdictions the priority must first remain on improving financial reporting. But public sector entities that already use accrual-based financial accounting and reporting have an obligation to lead—now—in this evolution of reporting and accountability.

- Global sustainability reporting guidance: IPSASB, as the global accounting standard-setter for the public sector, has a key role to play in monitoring developments in sustainability reporting (such as the IFRS Foundation[33]) and engaging in discussions related to developments in the broader reporting space for the public sector, including considering the potential public sector applicability of the guidance developed, and the need to modify or develop additional guidance to meet the specific needs of the sector.

Going forward, public sector accountability and trust will hinge on strong governance and transparent financial and non-financial reporting by governments and public sector entities. Enhancing transparency in public sector reporting will sustain the mandate on which public officials and institutions rely to operate on behalf of stakeholders (i.e., citizens), and underpin an informed debate about longer-term tax and spending. The pace and focus of reporting non-financial information will be driven by specific information demands from specific stakeholder groups. The combination of the urgent need for action to prevent further climate change, alongside the need for better information to support the difficult decisions that most governments face following the pandemic, may provide the catalyst for such reporting changes. The accountancy profession can play a critical role in implementing strong governance and PFM globally, drawing on the skills and ethics of individual professional accountants, we can effectively navigate to a prosperous, inclusive, and sustainable future for everyone.

31. IFAC: From Crisis to Recovery: Public Sector Priorities to Support COVID-19 Recovery - Taking healthcare as an example, it is important not to only deal with the current health emergency, but also tackle the underlying causes of poor health outcomes by focusing spending on areas that will address structural challenges. For example, consider increasing investment in preventative care to reduce future pressures on acute healthcare. Ultimately, this requires a holistic strategy that factors in other related areas such as social care, housing, and education, all of which have an impact on health outcomes.

33. In recent years, the private sector has increasingly recognized the urgent need for better sustainability and other non-financial information, and the IFRS Foundation and others are taking steps to enhance corporate reporting.