James Hopkinson, Chief Financial Officer for Regions and Clients, Standard Chartered Bank shared his perspectives on the finance function transformation journey with IFAC’s Professional Accountants in Business Committee during their meeting in Singapore.

Standard Chartered is an international banking group, predominantly operating in Asia, Africa and the Middle East.

Judy Hsu, Regional CEO, ASEAN & South Asia, set the context for the session, sharing her view that the CFO is one of the closest partners to the CEO. In short, the CFO is a business partner focusing externally on the markets and clients, providing insights to drive the business as well as critical challenge to decision making.

Recognizing that a shift in mindset will be critical to the bank’s future success, they are asking themselves: “Are we the incumbent or are we the challenger?” A key part of her role as CEO is to encourage and facilitate the organization to think like a disruptor and not to be constrained by a legacy mindset. At the same time ensuring that their purpose to drive commerce and prosperity remains at the heart of everything they do.

“Never again will the rate of change be as slow as it is today.”

James shared insight into the transformation journey of Standard Chartered’s finance function; from where they stand today, to where they want to be, how they are managing change, and his views on the pivotal role of the CFO in leading strategic change.

The finance function today

- Currently, the finance function’s operational processes are predominantly manual and, as a result, are quite resource-intensive.

- The finance function is regarded highly by the business and its views are respected by internal customers. However, there is a perception that it is a primarily technical function.

- The operating model of the finance function today is not sustainable. Processes, policies and procedures will be increasingly automated, and new accountants will not be as high in demand for process roles as they were previously.

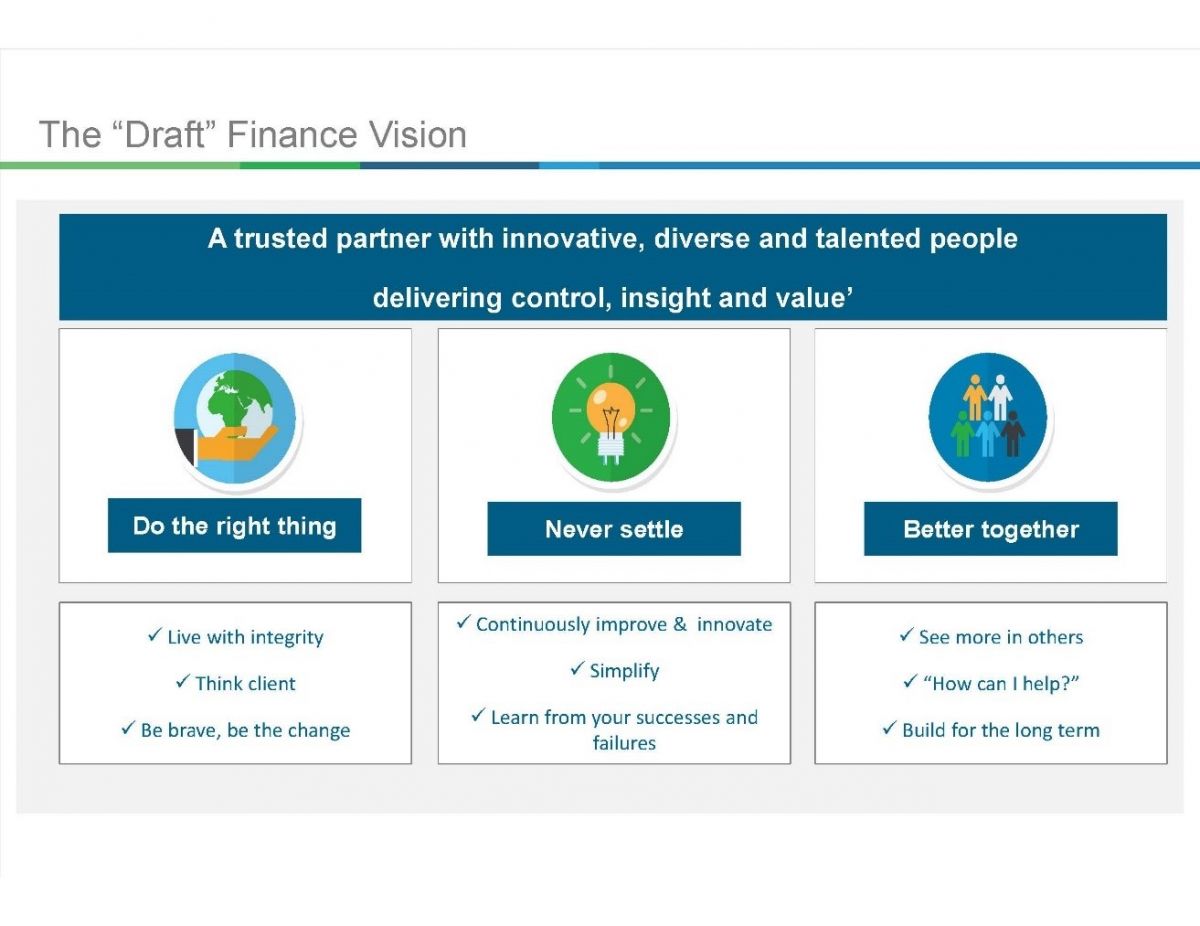

- The vision for the finance function is that it will be a business partner and enabler of value creation. This shift in roles and expectations is already in process, and is leading to a greater focus on delivering insights, which results in greater trust with others in the organization.

- Business leaders want:

Understanding and addressing business needs

- Business leaders want:

- Everyone to have timely access to data–often in a way they can interrogate themselves to make business decisions.

- The CFO and finance function to act as advisors on the future of the business, supporting management in a thoughtful way, while also challenging conventional thinking where necessary.

- To respond efficiently to external events or new regulations. This requires a finance function that has its pulse on trends and events in the business environment. Those that only look internally are “doomed”.

- The finance operating model must better support the business. It requires change in:

- People, organization and culture

- Processes–eliminate, standardize, centralize and automate

- Systems and data upgrade.

Enabling people-centered change

“People adopt what they help to create.”

- 75% of large change programs fail to achieve their objectives. Why? Because they start with technology, not people and behaviors.

- 80% of programs with a clear people-centered change focus do achieve their benefit targets

- Leading with a mindset shift that addresses what people do and how they can be part of the solution is critical.

- Mindsets are built over decades. Attempting to change mindsets in just a few months requires an element of unlearning. If employees are surrounded by others who aren’t changing, the challenge becomes harder.

- Standard Chartered’s finance function is in the middle of a transformation supported by:

- Executive and senior management

- Attitudes that see change as exciting and inevitable, and satisfaction that they are playing a central part in designing their own future

- Technology that enables change and exponential thinking to overcome legacy challenges and provides the opportunity to enhance the finance function’s overall contribution to the organization.

CFO role in transformation

- The CFO is an important catalyst for strategic change. And if they are not, then a different CFO is needed.

- The CFO acts as a “co-pilot” alongside the CEO, focused on driving business growth, people capability, technology and innovation. This is a shift from being a “navigator” that simply helps steer the organization towards achieving predetermined strategic objectives, to working in partnership with leadership to make difficult decisions, and engaging the organization on the right challenges and opportunities.

- It is important that the CFO:

- Is honest and transparent – tone at the top is critical

- Creates an environment that embraces change

- Listens to their teams

- Ensures that each team understands that they must become more valuable

- Although there is uncertainty on what the world will be like in 3 years’ time, strong leadership and a vision are very important to provide direction and context for every decision.

- Standard Chartered established a CFO Academy for mid-level and emerging talent, designed internally in partnership with Duke University and Korn Ferry, a global organizational consulting firm.

- The focus of the CFO Academy is on developing within the finance function key skills needed for the future, such as leadership, communication, empathy, and collaboration.

- The program is designed to take people out of their comfort zones in areas where their experience is limited. The team found thinking like clients the most difficult.

Building successful finance leaders of the future

“What made them successful up until now, may not make them successful in the future”

- Standard Chartered established a CFO Academy for mid-level and emerging talent, designed internally in partnership with Duke University and Korn Ferry, a global organizational consulting firm.

- The focus of the CFO Academy is on developing within the finance function key skills needed for the future, such as leadership, communication, empathy, and collaboration.

- The program is designed to take people out of their comfort zones in areas where their experience is limited. The team found thinking like clients the most difficult.

Taken from the IFAC PAIB Committee report, Perspectives on the Finance Function Journey