Recent Articles

-

Public Trust in Tax 2025: Asia and Beyond — Lessons on Building, Earning and Sustaining Trust

February 18, 2026 • Cecile Bonino, Jason Piper -

SAICA’s Role in Supporting South Africa’s Exit From the FATF Greylist

January 28, 2026 • Milton Segal -

What’s New for the IESBA Code: 2024 Edition and beyond

July 15, 2025 • Christopher Arnold, Michelle Cardwell -

Public Trust in Tax: A Global and Regional Imperative for Fair and Effective Systems

February 14, 2025 • Cecile Bonino, Scott Hanson, Jason Piper -

Designing and Implementing an Investigation and Discipline Framework: A Case Study from Emirates Association for Accountants and Auditors

-

What’s New for the IESBA Code: 2023 Edition and Beyond

August 6, 2024 • Christopher Arnold, Michelle Cardwell -

Accountants & Finance Function Uniquely Placed to Support Ethical Integrity and Anti-Corruption Efforts, say Global Experts

July 23, 2024 • Laura Takamizawa, Cecile Bonino, Scott Hanson -

Strengthening the IAASB's Fraud Standard through 7 Key Changes

April 23, 2024 • Nathalie Baumgaertener Dutang -

IFAC Accelerates Engagement on Anti-Corruption and Anti-Money Laundering at Key Global Forums

April 10, 2024 • Scott Hanson, Cecile Bonino -

Global Experts Call for Cooperation Across All Sectors and Professions to Turn the Tide Against Corruption

March 1, 2024 • Cecile Bonino, Dr. Susanna Di Feliciantonio

Links to External Content

-

Collective Investment Vehicles and Pension Funds Project Team Report

January 30, 2026 • ethicsboard.org -

Driving child-lens investing

Jan 16, 2026 • ACCA -

Firm Culture and Governance Dialogues

January 10, 2026 • ethicsboard.org -

Linkages between IESBA Viewpoints and ISQM 1

January 6, 2026 • ethicsboard.org -

Briefing Note: IESBA Firm Culture & Governance Project

January 6, 2026 • ethicsboard.org -

Ethics and The Power of One

Jan 5, 2026 • The Institute of Chartered Ac… -

2024 in Focus: Standards, Strategy, and Service in the Public Interest

December 5, 2025 • iaasb.org, ethicsboard.org -

7 principles for AML Regulatory Technical Standards development

Nov 3, 2025 • Accountancy Europe -

Everyday ethics: Pricing fairness in professional services

Oct 29, 2025 • In The Black -

2025 Handbook of the International Code of Ethics for Professional Accountants

October 7, 2025 • ethicsboard.org -

Everyday ethics: Referring in a client’s best interests

Sep 16, 2025 • In The Black -

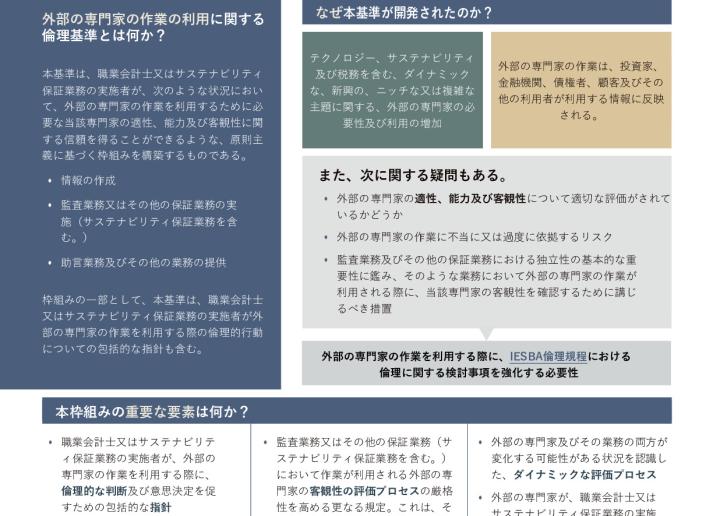

IESBA Staff Questions & Answers - Using the Work of an External Expert

-

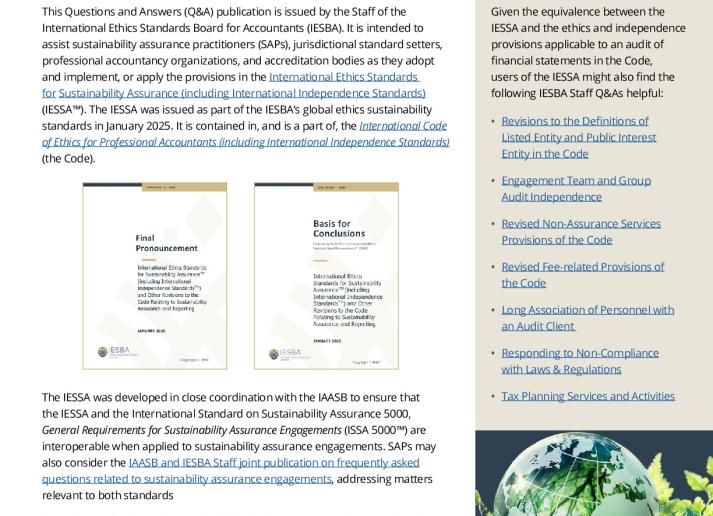

IESBA Staff Publication - Proportionality of IESSA

-

Everyday ethics: Who really owns the client?

Aug 29, 2025 • In The Black -

Endringer i ISA 700 og ISA 260

August 21, 2025 • iaasb.org -

Vergi Planlaması ve İlgili Hizmetler Projesi Kapsamında Etik Kurallar’da Yapılan Değişiklikler

August 1, 2025 • ethicsboard.org -

IESBA Staff Alert – Private Equity Investment in Accounting Firms

-

Summary of Prohibitions in the IESSA™

-

Key Differences Between The IESSA™ and the Provisions of the IESBA Code Applicable to an Audit of Financial Statements

-

Reglementare finală: Modificări ale Codului privind definiția echipei misiunii și a auditului grupului

July 29, 2025 • ethicsboard.org -

Modificaciones de alcance limitado a la NIA 700 (Revisada) y NIA 260 (Revisada)

July 23, 2025 • iaasb.org -

Firm Culture & Governance - IESBA Summary of Feedback from Global Roundtables

July 17, 2025 • ethicsboard.org -

Ändringar av Etikkoden avseende skatteplanering och näraliggande tjänster

July 7, 2025 • ethicsboard.org -

MANUEL DU CODE INTERNATIONAL DE DÉONTOLOGIE DES PROFESSIONNELS COMPTABLES (Y COMPRIS LES NORMES INTERNATIONALES D’INDÉPENDANCE)

July 7, 2025 • ethicsboard.org -

تحديثات على الميثاق فيما يتعلق بالتقنية

-

تعديلات محدودة على المعيار الدولي للمراجعة 700 "تكوين الرأي والتقرير عن القوائم المالية" والمعيار الدولي للمراجعة 260 "الاتصال بالمكلفين بالحوكمة"

July 3, 2025 • iaasb.org -

Everyday ethics: Competency in referrals

Jul 3, 2025 • In The Black -

Closing that Gap: Educating the Finances of the Future of Accountants on Financial Reporting Ethics

Jul 3, 2025 • Modern Ghana -

국제윤리기준위원회(IESBA) 회계법인의 조직문화 및 지배구조 워킹그룹 최종 보고서

July 2, 2025 • ethicsboard.org -

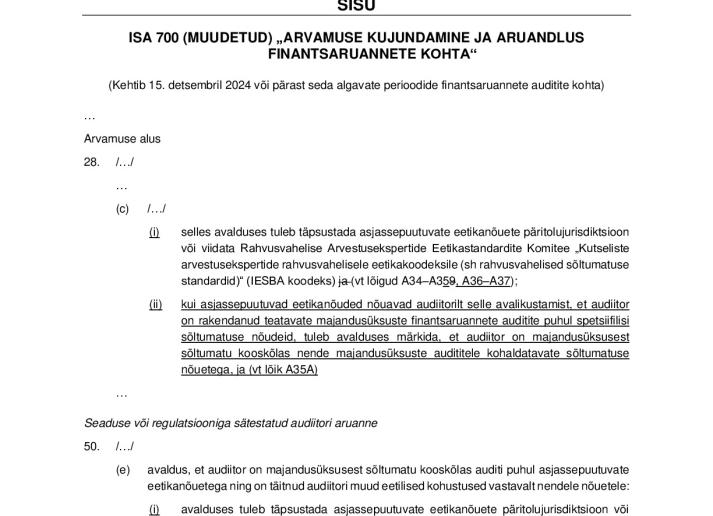

ISA 700 (MUUDETUD) JA ISA 260 (MUUDETUD) PIIRATUD KOHALDAMISALAGA MUUDATUSED, MIS TULENEVAD IESBA KOODEKSI[1] MUUDATUSTEST, MIS NÕUAVAD ETTEVÕTTELT SELLE AVALIKUSTAMIST, ET ETTEVÕTE ON RAKENDANUD SÕLTUMATUSE NÕUDEID AVALIKU HUVI ÜKSUSTE PUHUL

July 1, 2025 • iaasb.org -

KUTSELISTE ARVESTUSEKSPERTIDE EETIKAKOODEKS (EESTI) (SH SÕLTUMATUSE STANDARDID)

July 1, 2025 • ethicsboard.org -

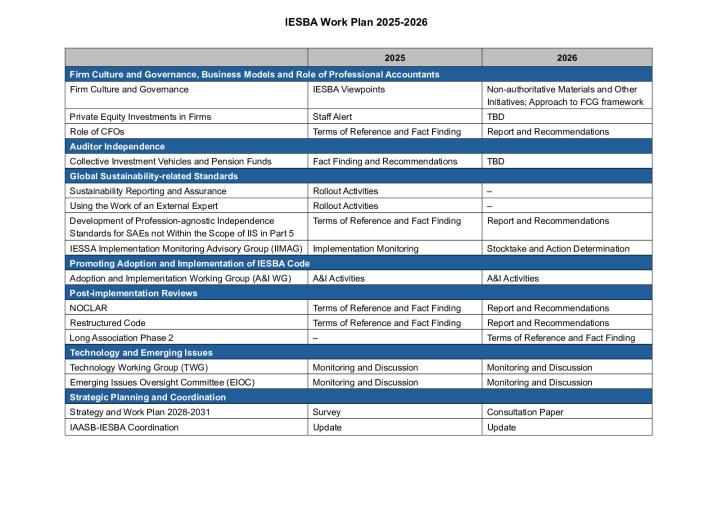

IESBA Work Plan 2025-2026

June 30, 2025 • ethicsboard.org -

Revize definic Etického kodexu: definice kotované účetní jednotky a subjektu veřejného zájmu

June 26, 2025 • ethicsboard.org -

Revize ustanovení Etického kodexu týkajících se užívání technologií

-

Revize ustanovení Etického kodexu týkajících se definice týmu provádějícího zakázku a auditu skupiny

June 26, 2025 • ethicsboard.org -

Harmonizační novela Etického kodexu vyplývající z nových standardů pro řízení kvality

June 26, 2025 • ethicsboard.org -

Propuesta de Memorándum Explicativo para las Normas Internacionales de Ética para el Aseguramiento de la Sostenibilidad (incluidas las Normas Internacionales de Independencia) (NIEAS)

-

Propuesta de Normas Internacionales de Ética para el Aseguramiento de la Sostenibilidad (incluidas las Normas Internacionales de Independencia) (IESSA) y Otras Revisiones del Código Relacionadas con el Aseguramiento

-

最終公表:サステナビリティ保証業務に関する国際倫理基準(国際独立性基準を含む。)及びサステナビリティ保証業務・報告に関するその他のIESBA倫理規程の改訂

June 13, 2025 • ethicsboard.org -

Zmiany w Kodeksie dotyczące planowania podatkowego i usług powiązanych

June 12, 2025 • ethicsboard.org -

IESBA Staff Questions & Answers - International Ethics Standards for Sustainability Assurance (IESSA)

-

RAPORTUL FINAL AL GRUPULUI DE LUCRU AL IESBA PRIVIND CULTURA ȘI GUVERNANȚA FIRMELOR

May 30, 2025 • ethicsboard.org -

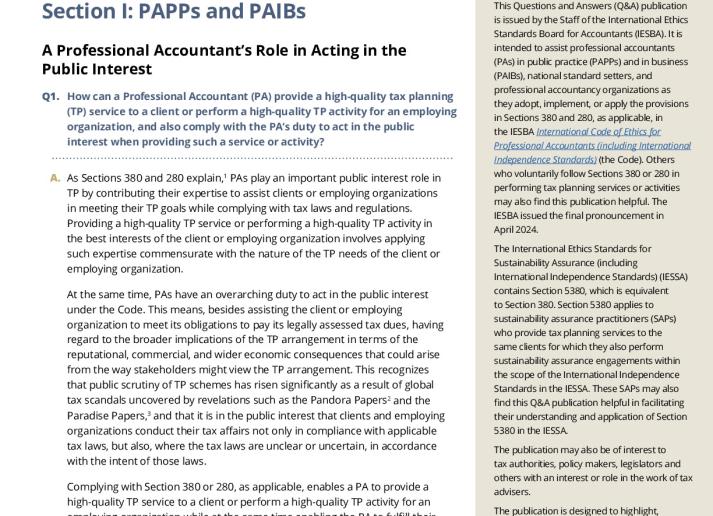

IESBA Staff Questions & Answers: Tax Planning Services and Activities

May 8, 2025 • ethicsboard.org -

Financial abuse (and what accountants can do to help)

May 2, 2025 • In The Black -

Organizational Culture and Behavior: A Synthesis of Academic Literature

April 14, 2025 • ethicsboard.org -

New EU AML rules: advice for accountancy practitioners

Apr 8, 2025 • Accountancy Europe -

ICAEW publishes 2025 update to Code of Ethics

Apr 1, 2025 • ICAEW -

最終公表:外部の専門家の作業の利用に関するIESBA倫理規程の改訂

March 31, 2025 • ethicsboard.org -

IESBA Webinar - Using the Work of an External Expert

-

IESBA Webinar - IESSA Independence Standards: A Deep Dive

-

Borsada İşlem Gören İşletme ve Kamu Yararını İlgilendiren Kuruluş Tanımları Projesi Kapsamında Etik Kurallar’da Yapılan Değişiklikler

March 13, 2025 • ethicsboard.org -

Teknoloji Projesi Kapsamında Etik Kurallar’da Yapılan Değişiklikler

March 13, 2025 • ethicsboard.org -

Bağımsız Denetçiler İçin Etik Kurallar’ın Revize Edilmesi Nedeniyle BDS 700 ve BDS 260’ta Yapılan Değişiklikler

March 13, 2025 • iaasb.org -

Proponowane Międzynarodowe standardy etyki w zakresie atestacji zrównoważonego rozwoju (w tym Międzynarodowe standardy niezależności) (IESSA) oraz inne zmiany do Kodeksu związane z atestacją i sprawozdawczością zrównoważonego rozwoju – Wersja z zaznaczony

-

IESBAスタッフQ&A「上場事業体及び社会的影響度の高い事業体の定義に関するIESBA倫理規程の改訂」

March 11, 2025 • ethicsboard.org -

A Kódex technológiával kapcsolatos felülvizsgálatai

March 10, 2025 • ethicsboard.org -

最終公表:タックス・プランニング及び関連業務に関するIESBA倫理規程改訂

March 5, 2025 • ethicsboard.org -

Pytania i odpowiedzi pracowników IESBA: Zmiany w definicjach jednostki notowanej na giełdzie papierów wartościowych i jednostki zainteresowania publicznego w Kodeksie (wrzesień 2024 r.)

March 4, 2025 • ethicsboard.org -

Zmiany w Kodeksie związane z technologią

-

Міжнародний кодекс етики професійних бухгалтерів (включаючи Міжнародні стандарти незалежності), видання 2023 року

March 4, 2025 • ethicsboard.org -

Revize Etického kodexu doplňující ustanovení týkající se daňového plánování a souvisejících služeb

February 28, 2025 • ethicsboard.org -

Moral Decision-Making Model for Accountants

-

The new ethics of tax planning

Jan 30, 2025 • In The Black -

Everyday ethics: Long-term audit clients

Jan 30, 2025 • In The Black -

Everyday ethics: The price of deferring costs

Nov 21, 2024 • In The Black -

Everyday ethics: How to communicate ESG with authenticity

-

Ethics and accountants: 5 expert insights

Sep 26, 2024 • CPA Australia -

IESBA's strategic roadmap explained

Sep 26, 2024 • CPA Australia -

Acting in the Public Interest

Aug 30, 2024 • Malaysian Institute of Accoun… -

Ethical intelligence for accountants

Aug 29, 2024 • CPA Australia -

The Amplified Role of Professional Accountants in Anti-Money Laundering

-

6 steps to repair broken trust at work

Jul 22, 2024 • CPA Australia -

Les systèmes d’éthique : Comment le professionnel comptable peut favoriser l’adoption de comportements adaptés

Jul 5, 2024 • CPA Canada -

Navigating Ethical Systems: How professional accountants can drive ethical behaviour

Jul 5, 2024 • CPA Canada -

Everyday Ethics: Going into business with a client

Jun 20, 2024 • CPA Australia -

Navigating the perils of cognitive bias in accounting

May 24, 2024 • CPA Australia -

Everyday ethics: How to handle conflicts of interest

May 8, 2024 • CPA Australia -

Payroll fraud: what it is and how to prevent it

Apr 11, 2024 • CPA Australia -

Foresight Podcast Episode 5: Meet the tax advisor’s newest partner: AI

Apr 9, 2024 • CPA Canada -

Public Intefrity Indicators

-

Anti-Corruption and Integrity Outlook 2024

-

Resource Guide on State Measures for Strengthening Business Integrity

Apr 2, 2024 • OECD -

Everyday ethics: Confidentiality at work

Mar 28, 2024 • CPA Australia -

The future of cons and frauds

Feb 15, 2024 • CPA Canada -

Generative AI in business: how to navigate the ethics

Feb 7, 2024 • CPA Australia -

Congreso Internacional de Mujeres en el Combate al Lavado de Dinero y Corrupción – día 2

Feb 2, 2024 • IMCP -

Foro Internacional de Mujeres en el Combate al Lavado de Dinero y Corrupción – día 1

-

Global Risks Report 2024 - watch live

-

Accountants on the front line of whistleblower protection

Jan 8, 2024 • Corporate Disclosures -

What do you do now? ICAS publishes updated ‘Shades of Grey’ ethics case studies

Dec 15, 2023 • ICAS -

IESBA Staff Releases Q&As to Support Adoption and Implementation of International Independence Standard on Group Audits

Oct 23, 2023 • https://www.ethicsboard.org -

CPAs are the stewards of trust and ethics in the digital age

Oct 13, 2023 • CPA Canada -

The challenge of forensic accounting in the digital economy

-

What is workplace trust in the digital age?

Sep 28, 2023 • CPA Australia -

Everyday ethics: Conflicts of interest

Sep 28, 2023 • CPA Australia -

Ethics recordings

-

How the experts expose financial statement fraud

Aug 17, 2023 • CPA Australia -

'To work in the AML field, you have to want to make a difference'

Aug 15, 2023 • CPA Canada -

The use of cryptocurrency in business

Aug 4, 2023 • Deloitte -

3 skills accountants need in a ‘post-truth’ era

Aug 3, 2023 • CPA Australia

IFAC Research & Publications

-

2024 in Focus: Standards, Strategy, and Service in the Public Interest

December 5, 2025 -

Public Trust in Tax 2025: Asia and Beyond

December 4, 2025 -

IFAC Response to IESBA Consultation on Auditor Independence: CIVs and Pension Funds

June 24, 2025 -

Mentalidad integrada en la práctica: contadores profesionales en empresas y cumplimiento anticorrupción

March 4, 2025 -

Hizmet Akdi ile Çalışan Muhasebe Meslek Mensupları ve Yolsuzlukla Mücadele Uyum Süreçleri

March 4, 2025 -

CONFIANZA PÚBLICA EN LOS IMPUESTOS 2024: AMÉRICA LATINA Y MÁS ALLÁ

January 27, 2025 -

Public Trust in Tax 2024: Latin America and Beyond

December 11, 2024 -

Integrated Mindset in Practice: Professional Accountants in Business and Anti-Corruption Compliance

July 3, 2024

IFAC Press Releases

-

New Report from International Federation of Accountants, ICAEW, and Basel Institute on Governance Urges Accountants in Business to Continue to Lead Anti-Corruption Actions

July 3, 2024 -

Global Accountancy Profession’s Response to the IESBA’s Proposed International Ethics Standards for Sustainability Assurance

May 30, 2024 -

Publication d’un rapport de l’IFAC et de CPA Canada sur le rôle essentiel de la protection des lanceurs d’alerte dans une culture de prise de parole

December 8, 2023 -

New IFAC and CPA Canada Report Explores the Central Role of Whistleblower Protection in Supporting a Speak-Up Culture and Championing Whistleblowers’ Protection

December 8, 2023 -

IFAC, TI-UK, and World Economic Forum’s PACI Review of Anti-Corruption Reporting Sheds Light on Current Practice & Encourages Increased Transparency

May 25, 2023 -

New IFAC Publication Equips Accountancy Organizations to Lead the Fight Against Corruption

May 16, 2023 -

IFAC Calls on G20 Leaders to Cooperate to Solve Pressing Long-Term Issues; Pledges Ongoing Support from Accountancy Profession

November 1, 2022 -

Views on corruption drive attitude to tax systems across the globe

September 22, 2022