Case Study: Integrated Profit and Loss Accounting at Natura &Co

Presentation by Alessandra Segatelli, Controllership Director - LatAm, Natura &Co

|Natura’s purpose: To nurture beauty and relationships for a better way of living and doing business

Natura &Co believes that the value and longevity of a company are directly linked with its capacity to contribute to the evolution of society and its sustainable development. To collaborate with the wide-reaching change our world needs, it is fundamental for us to measure our legacy or, in other words, the impact we generate through our operation.

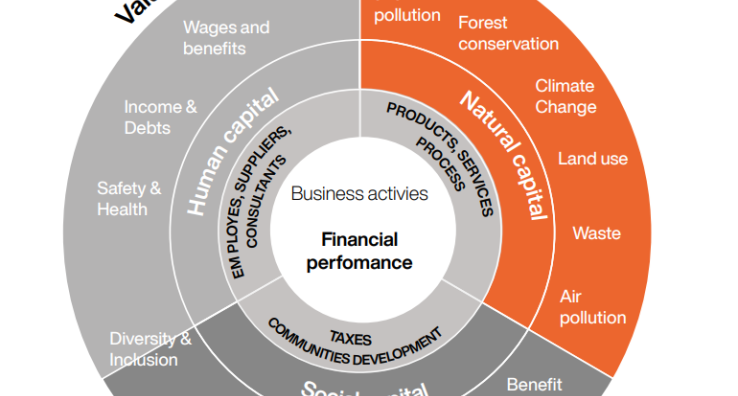

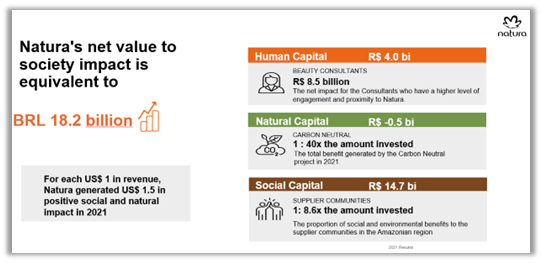

Natura’s leadership in impact accounting has culminated in its IP&L and underlying methodology to account in monetary values for the impacts of its corporate performance on environmental, social and human capital.

The IP&L methodology connects business activities to impacts and allows the attribution of value to impacts be they positive or negative. This provides quantitative information that permits better strategic decision-making aimed at leveraging positive impacts and mitigating negative ones, for example, in improving supply chain processes and vendor selection, and operations. It also allows decisions to be made to balance profitability at the same time as achieving sustainability goals.

Natura has a cross-functional committee responsible for the development and strategy of the IP&L methodology, which includes the controllership and technical accounting team, as well as members of the financial planning and analysis (FP&A) team and Sustainability Center of Expertise.

The development and publication of the IP&L started in 2010 with Natura’s efforts to understand its supplier network and key raw materials such as palm oil. Between 2014-16, Natura developed an Environmental Profit & Loss and expanded it to social impacts in 2017-19, particularly to measure and enhance the contribution of its approximately 2 million beauty consultants in Brazil, Argentina, Chile, Colombia, Mexico, Peru and Malaysia to their communities. A full IP&L model was issued in 2021 and is now included in internal decision-making and public disclosure with external assurance. The IP&L has become Natura’s Integrated Report.

The IP&L methodology relies mostly on the Natural Capital Protocol and the Human and Social Capital Protocol (Capitals Coalition, 2016, 2019). The methodology involves

The Natura &Co IP&L methodology is available at Natura Integrated Profit & Loss Accounting 2021, Technical Executive Summary and Insights. A summary is provided here.

The Role of the Finance Team

Natura’s Finance Team plays an important role in the measurement of impacts, supporting necessary data collection, monitoring the progress of socio-environmental issues and combating climate change through key indicators, supporting the establishment of tangible and relevant goals, and encouraging the creation of action plans to leverage all the company's results, whether economic, social, human or environmental.

Now, the integrated assessment that IP&L generates guarantees the implementation of ESG policies embedded in the day-to-day strategy of the group's companies, and ensures decisions always combine both the search for profitability and return to all stakeholders.

In terms of the external reporting and assurance process,

Through its controllership function, Natura also engages and influences external groups that are establishing standards, frameworks, and guidance including the IFRS Foundation and ISSB, the Capitals Coalition, Impact Management Project, Value Balancing Alliance, and World Business Council for Sustainable Development. To help develop the connectivity with financial statements, financial reporting standards could usefully develop common methodologies and accounting treatments for some ESG areas including carbon credits. International standards for measuring and valuing impacts would also help drive a more common approach to impact accounting that would lead to integrated reports being more quantitative.

This was a presentation to the IFAC Professional Accountants in Business Advisory Group during their September 2022 meeting. Read more insights from IFAC’s Professional Accountants in Business Advisory Group’s report: Professional Accountants as Finance and Business Leaders.